Liquid Asset Based Lending (LABL)

Lending responsibly against your investments

Capilever provides a fully automated, end-to-end solution for Liquid Asset Based Lending (LABL). Your daily banking app or PFM/BFM tool needs flexible financing solutions? We help you bring Liquid Asset Based Lending (LABL) to a larger retail, mass affluent and SME audience.

Liquid Asset Based Lending (LABL)

Lending responsibly against your investments

Capilever provides a fully automated, end-to-end solution for Liquid Asset Based Lending (LABL). Your daily banking app or PFM/BFM tool needs flexible financing solutions? We help you bring Liquid Asset Based Lending (LABL) to a larger retail, mass affluent and SME audience.

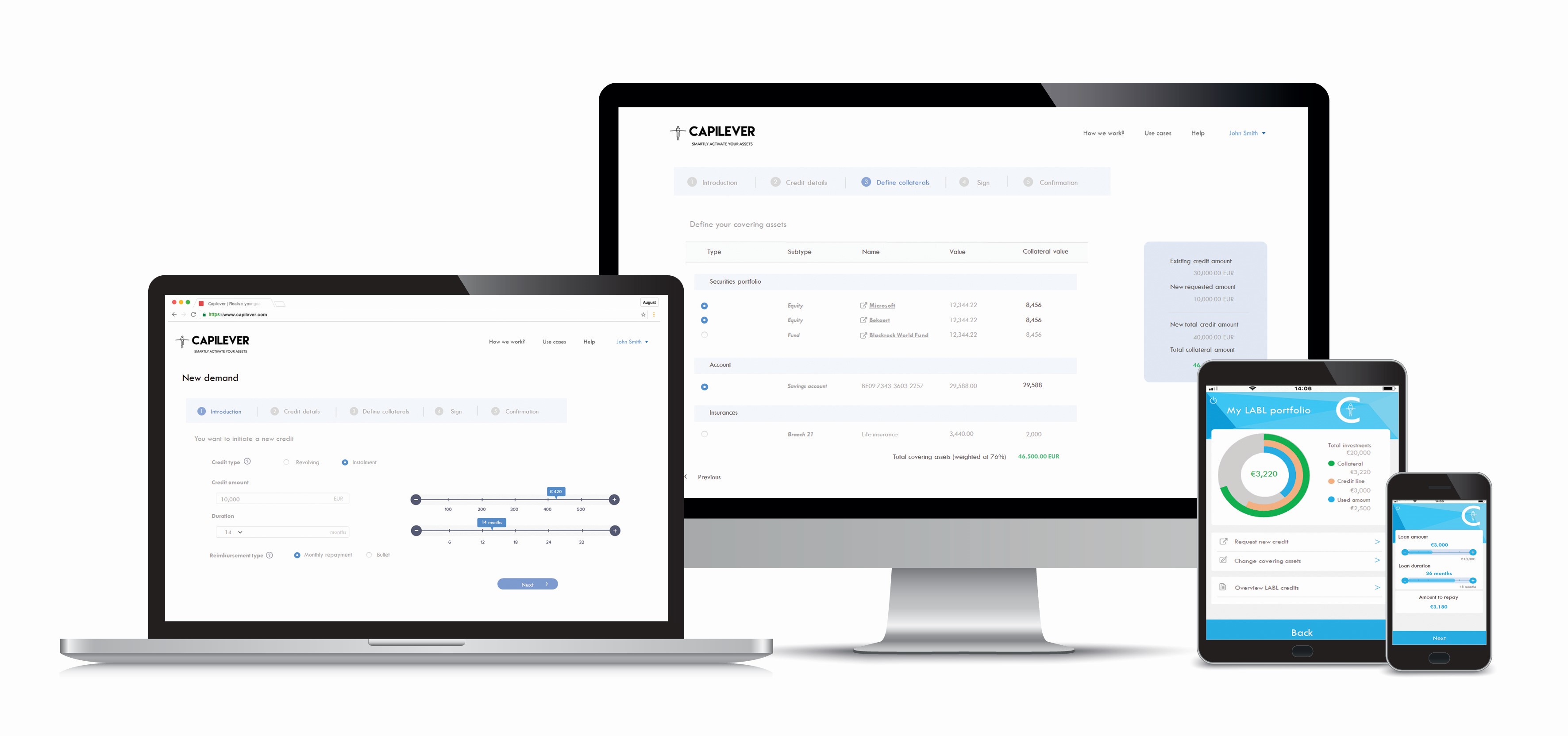

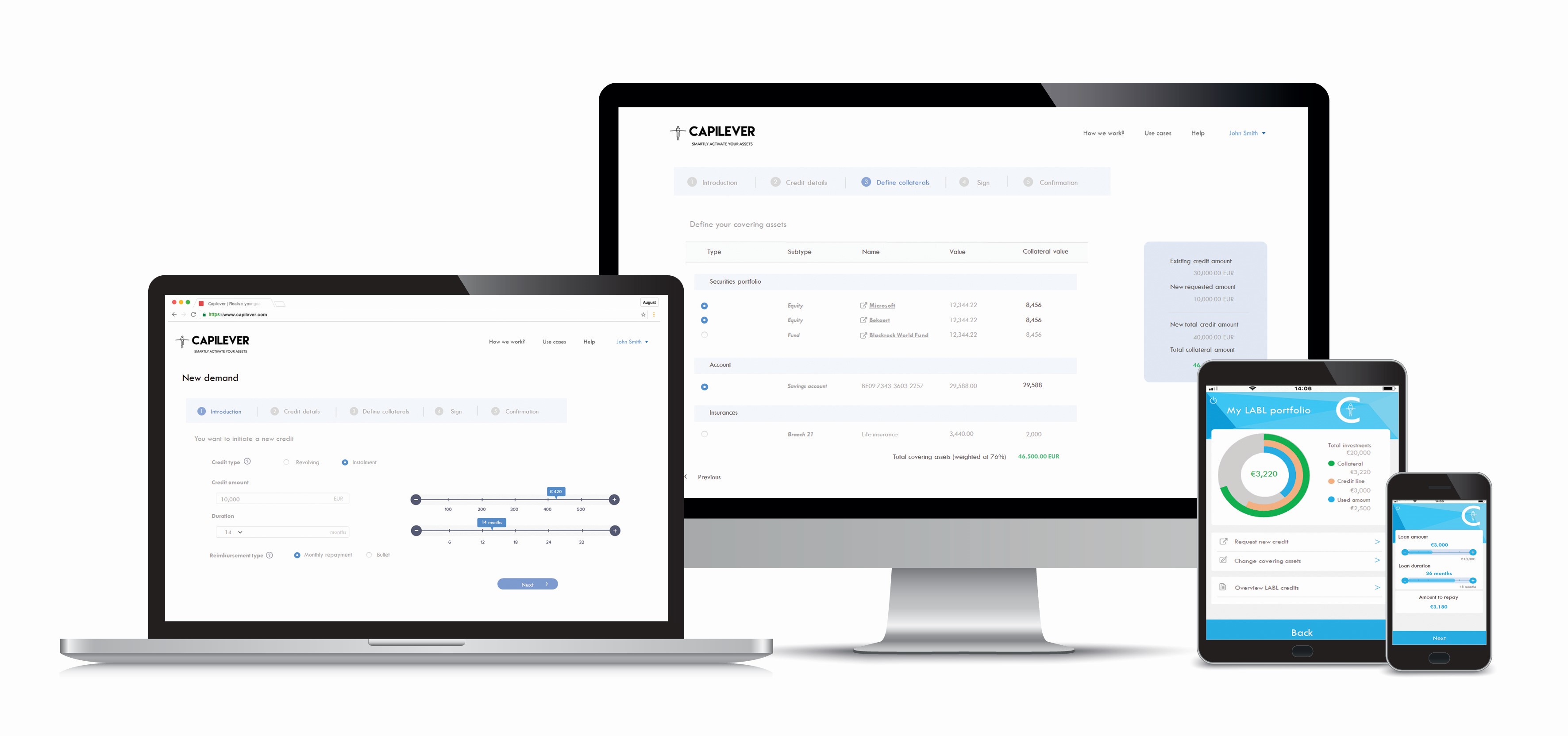

LABL software demo

LABL software demo

How does it work?

1

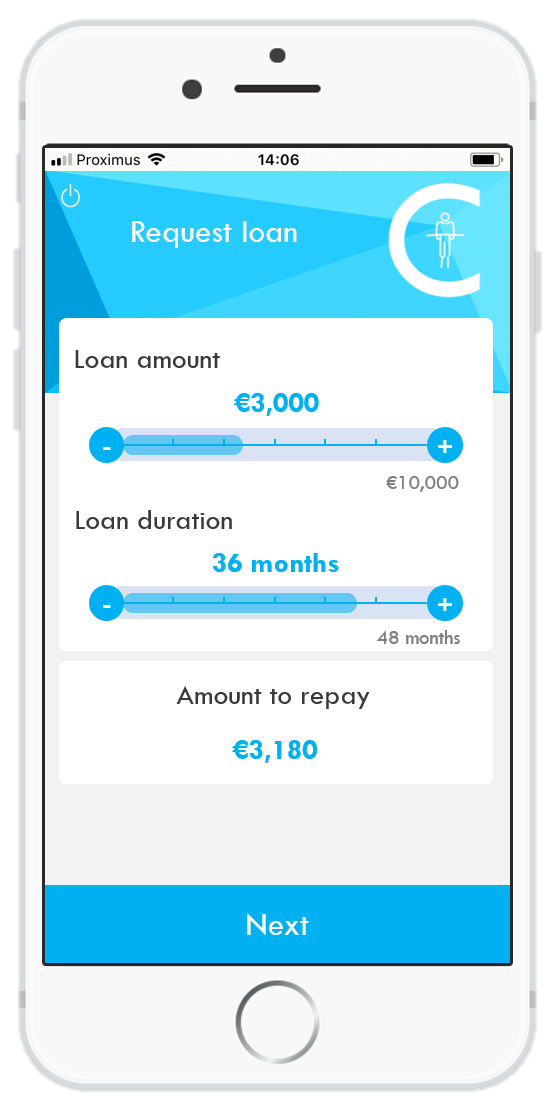

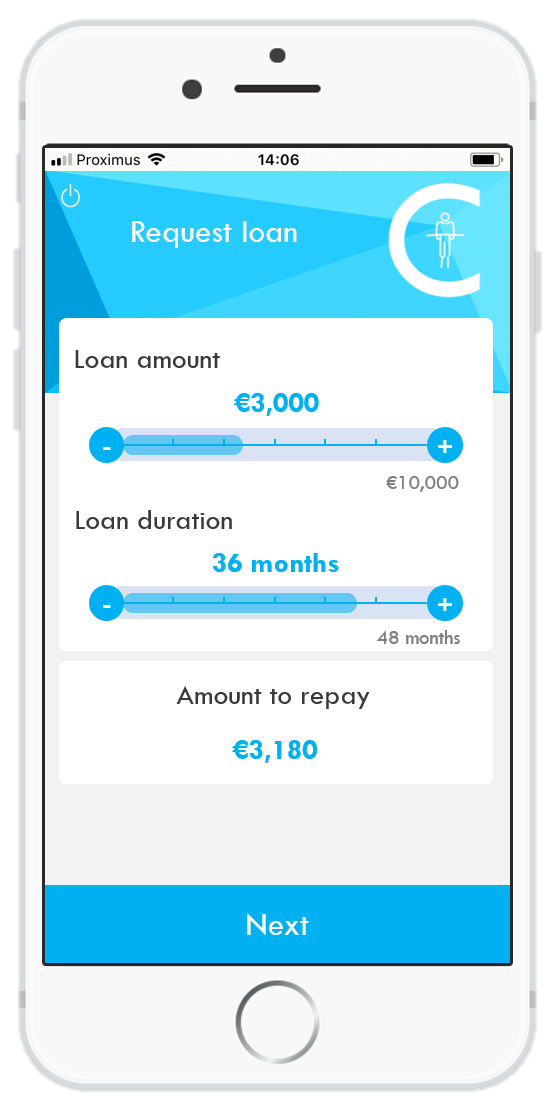

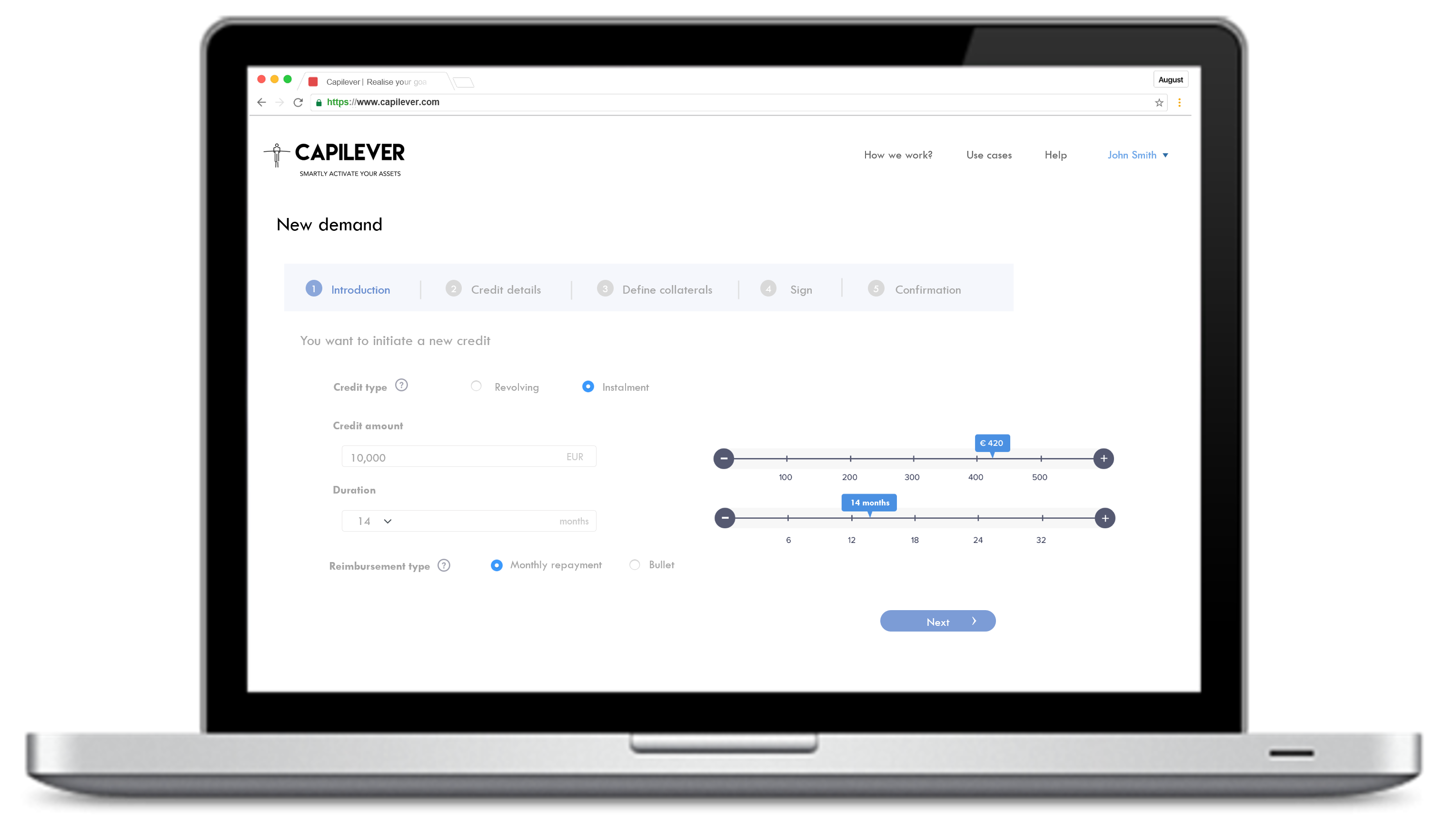

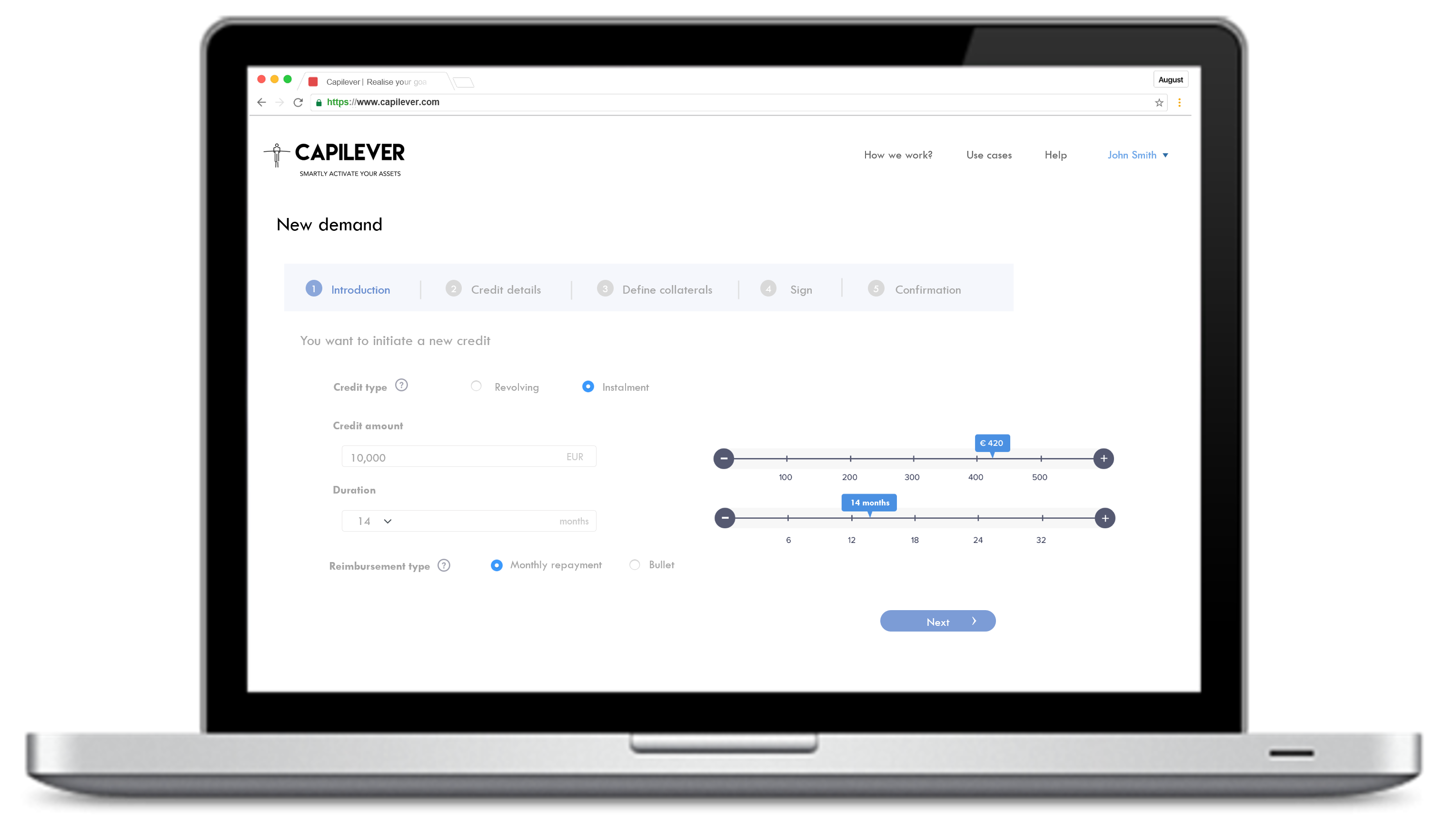

You define your short-term cash need

Fully online credit processing with immediate availability of cash. With a flexible choice between instalment credit or line.

2

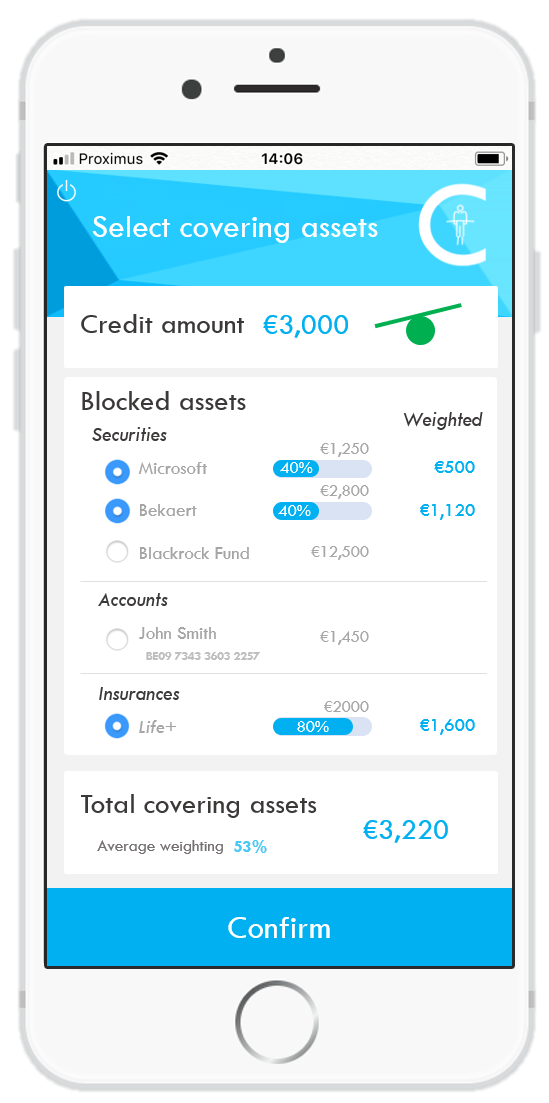

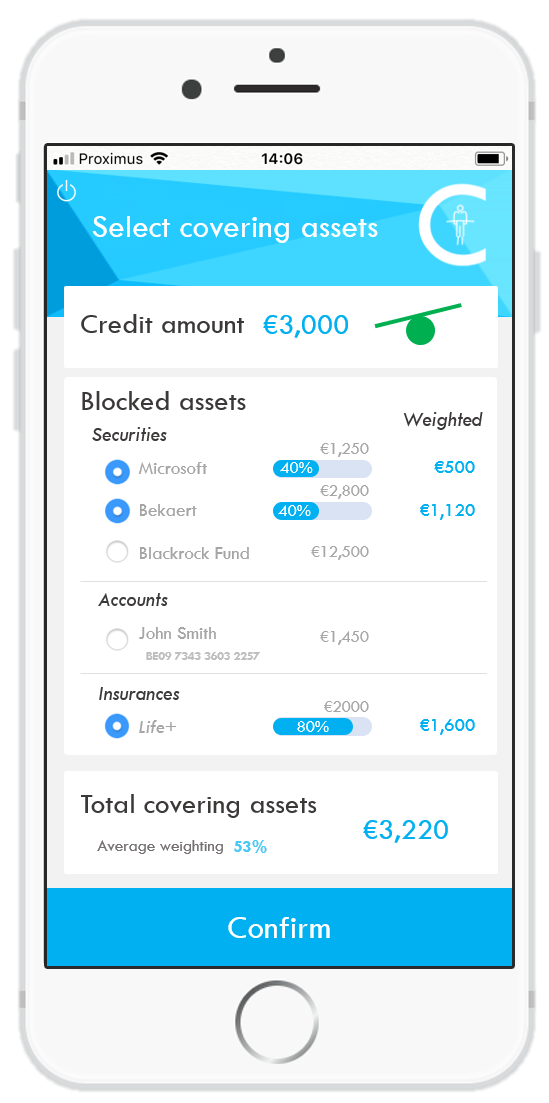

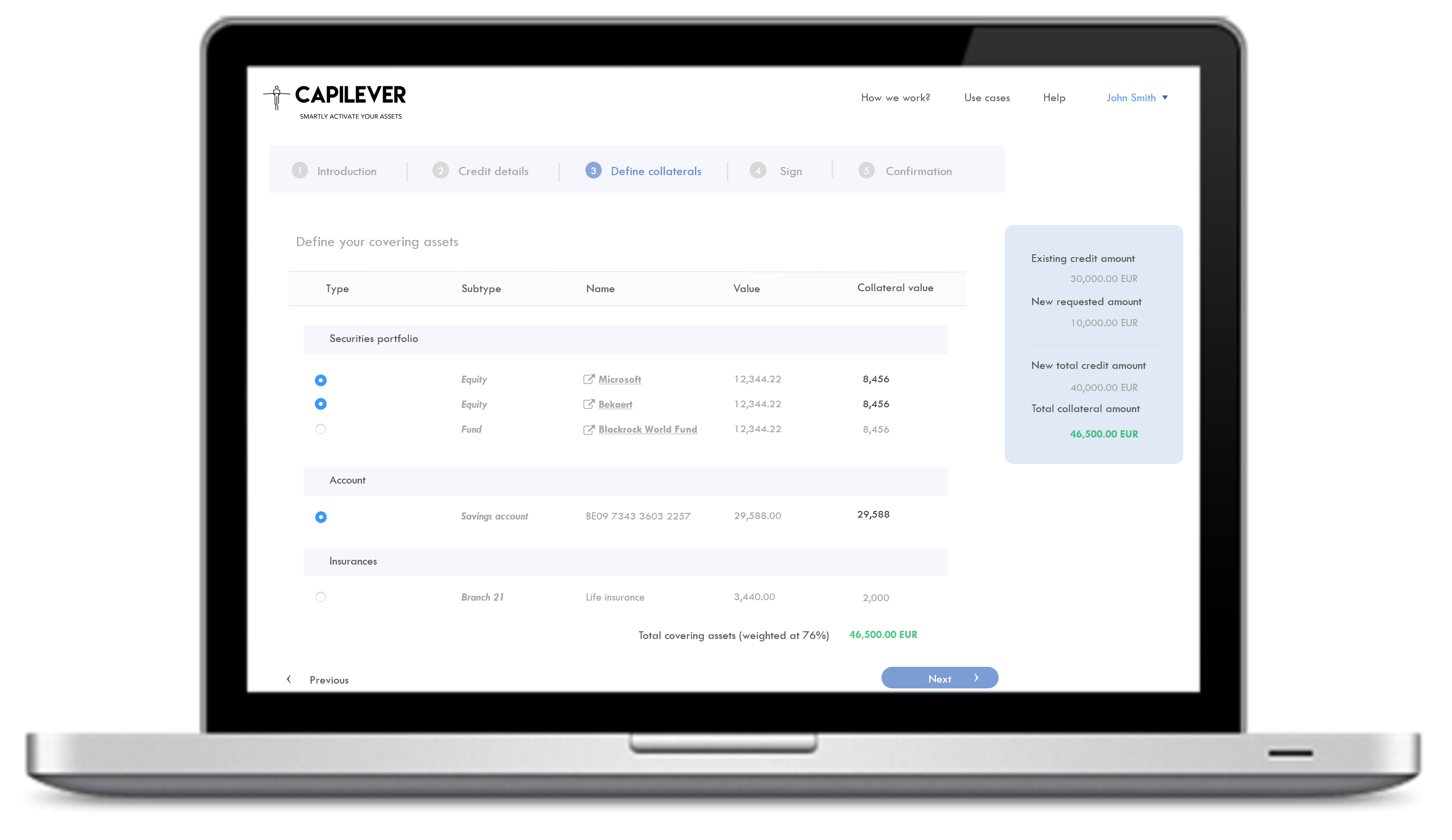

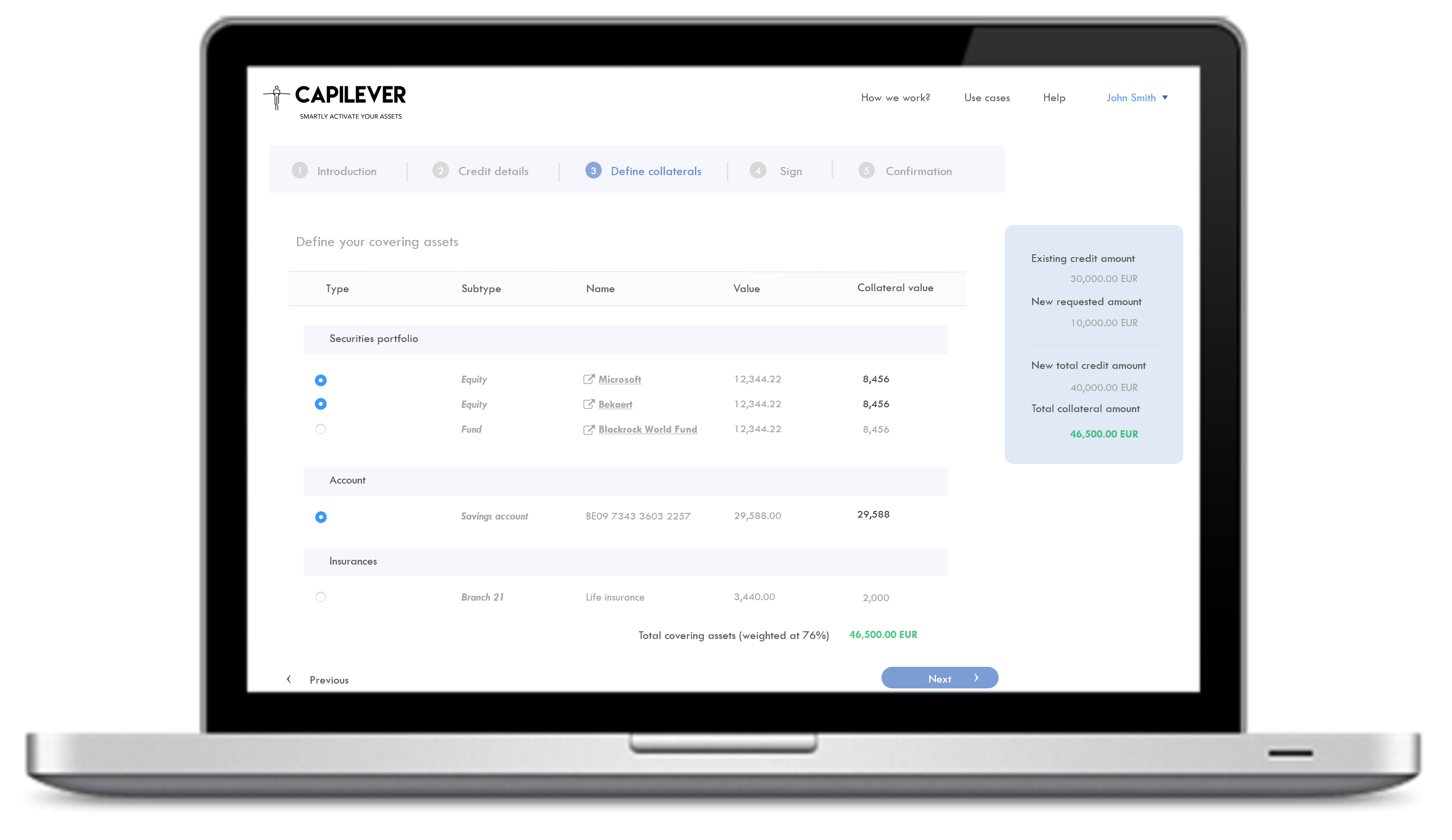

You select your covering assets

Overview of all assets which can be collateralized, with their actual value & pledging value (i.e. how much value can be used for pledging). Here you can selects assets you want to collateralize.

3

Your credit is disbursed in real-time

After signing credit demand, you define target cash account for credit disbursement or credit line facility, with immediate pay-out of the pre-approved credit (i.e. as fully backed by liquid assets).

4

You pay back when money is available again

You obtain additional capital without having to sell existing assets with flexibility of monthly installment repayments or bullet payment.

1

You define your short-term cash need

Fully online credit processing with immediate availability of cash. With a flexible choice between instalment credit or line.

2

You select your covering assets

Overview of all assets which can be collateralized, with their actual value & pledging value (i.e. how much value can be used for pledging). Here you can selects assets you want to collateralize.

3

Your credit is disbursed in real-time

After signing credit demand, you define target cash account for credit disbursement or credit line facility, with immediate pay-out of the pre-approved credit (i.e. as fully backed by liquid assets).

4

You pay back when money is available again

You obtain additional capital without having to sell existing assets with flexibility of monthly installment repayments or bullet payment.

What are your benefits ?

Quick and flexible source of money without impacting your ongoing investment strategy

You obtain additional capital without having to sell your existing assets which may have longer timespans and/or returns

You continue your (long-term) investment plan and enjoy full income potential of your assets

You still have the flexibility to adapt and restructure your investment portfolio without impacting your outstanding credit needs

You have access to a flexible, cost-efficient financing solution !

What are your benefits ?

Quick and flexible source of money without impacting your ongoing investment strategy

- You obtain additional capital without having to sell your existing assets which may have longer timespans and/or returns

- You continue your (long-term) investment plan and enjoy full income potential of your assets

- You still have the flexibility to adapt and restructure your investment portfolio without impacting your outstanding credit needs

- You have access to a flexible, cost-efficient financing solution !

INTEGRATE OUR APIs INTO YOUR DAILY BANKING APP

Perfectly compatible with your Internet Banking & PFM / BFM solutions

-

Open your asset backed facility, fully online, fully real-time by blocking and unblocking your assets as you wish

The SME or retail customer can easily open an ABL loan (credit line or installment credit) and select the covering assets. Customer sees overview of all their assets, which can be collateralized, with their actual value & pledging value (i.e. how much value can be used for pledging). In this view customer selects assets he wants to collateralize. After signing electronically the credit is disbursed in real-time.

Perfectly compatible with your Internet Banking & PFM / BFM solutions

The SME or retail customer can easily open an ABL loan (credit line or instalment credit) and select the covering assets. Customer sees overview of all their assets, which can be collateralized, with their actual value & pledging value (i.e. how much value can be used for pledging). In this view customer selects assets he wants to collateralize. After signing electronically the credit is disbursed in real-time.

-

Customer can block/ unblock positions as long as the total collateralization amount is larger than the total outstanding credit amount

Our software allows smartly weighting the covering assets based on asset type (equity, life insurance, saving account, bond, derivative…), asset subtype (e.g. corporate bond, convertible bond, …), bond rating (S&P, Moody’s or Fitch rating), currency, stock exchange (major stock exchange, acceptable stock exchange, emerging market, other), average daily turn over / market capitalization / number of outstanding stocks, and volatility.

Our software allows smartly weighting the covering assets based on asset type (equity, life insurance, saving account, bond, derivative…), asset subtype (e.g. corporate bond, convertible bond, …), bond rating (S&P, Moody’s or Fitch rating), currency, stock exchange (major stock exchange, acceptable stock exchange, emerging market, other), average daily turnover / market capitalization / number of outstanding stocks, and volatility.

-

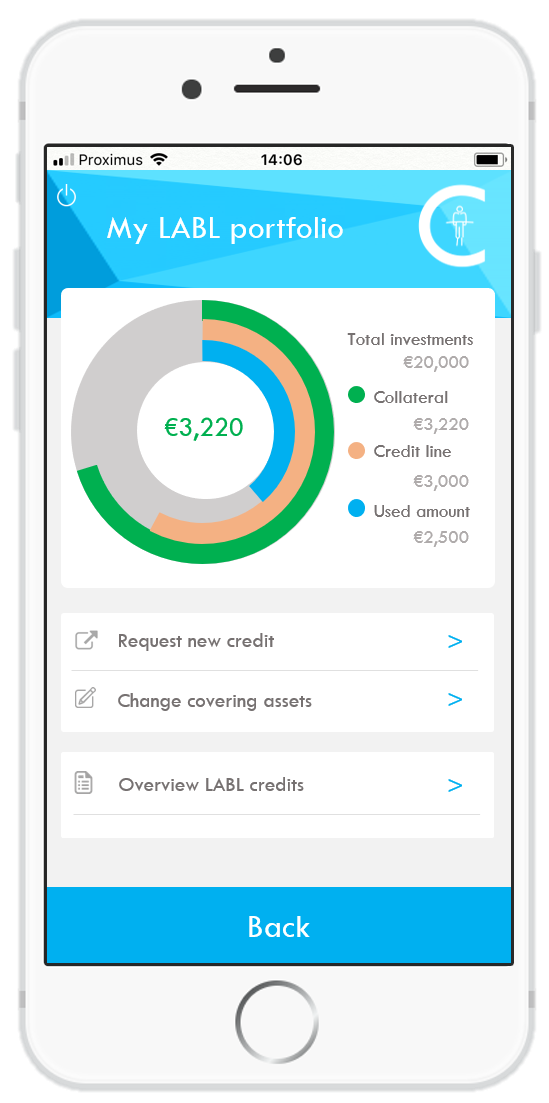

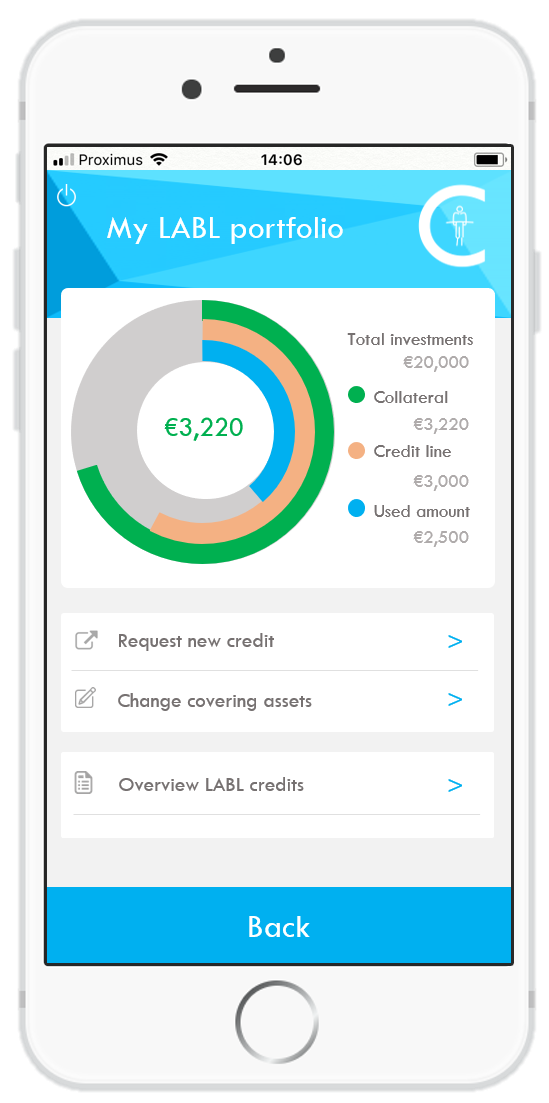

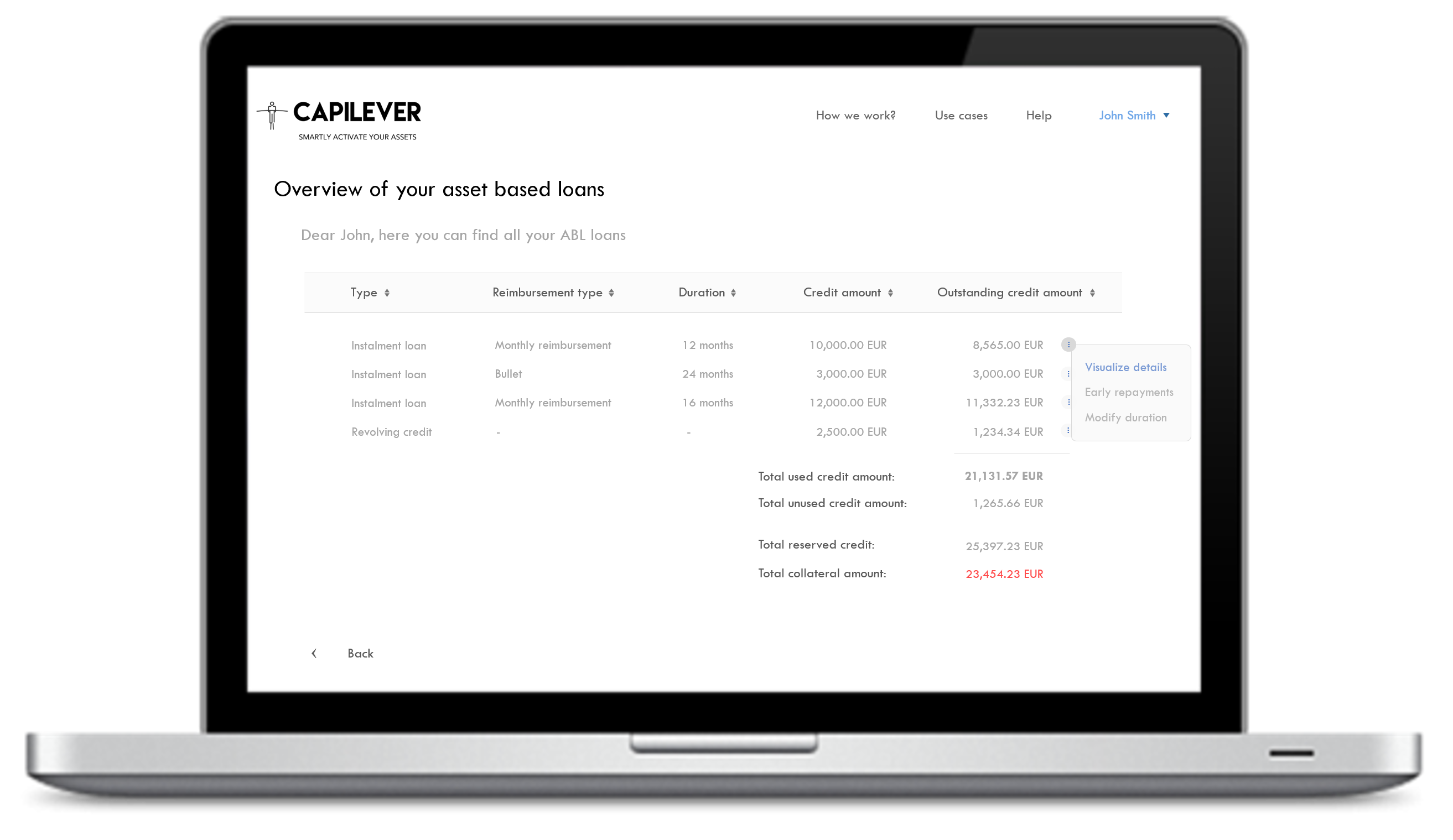

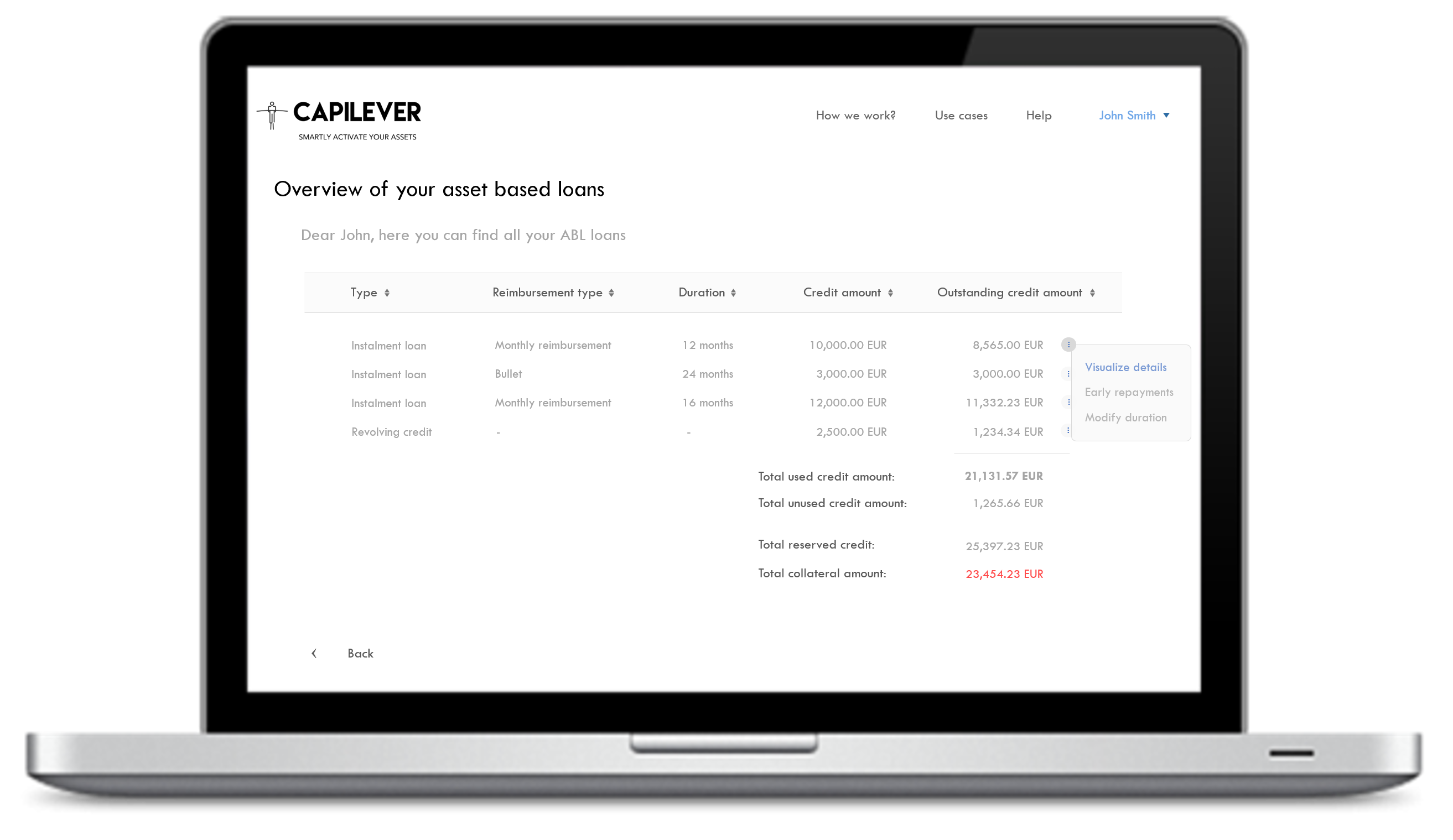

Get a clear overview of your ABL credit details and covering assets

From within your banking app you can easily consult your ABL credit details, for example the duration of the loan, the remaining amount, the reimbursement table, etc. We make sure you can make changes to your contract at all times, like making early repayments, changing the loan duration, changing the credit line amount, etc.

Get a clear overview of your ABL credit details and covering assets

From within your banking app you can easily consult your ABL credit details, for example the duration of the loan, the remaining amount, the reimbursement table, etc. We make sure you can make changes to your contract at all times, like making early repayments, changing the loan duration, changing the credit line amount, etc.

-

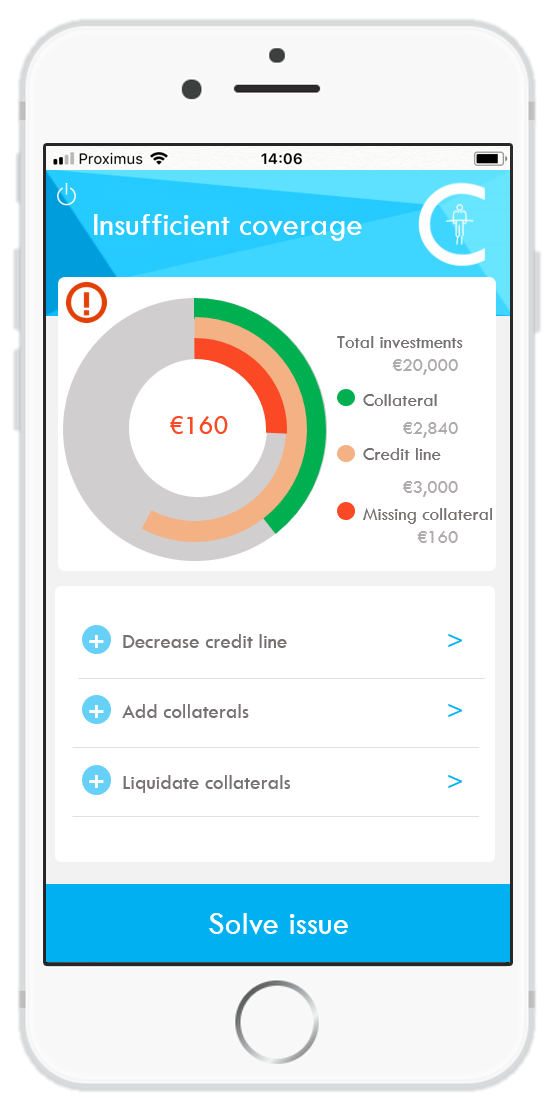

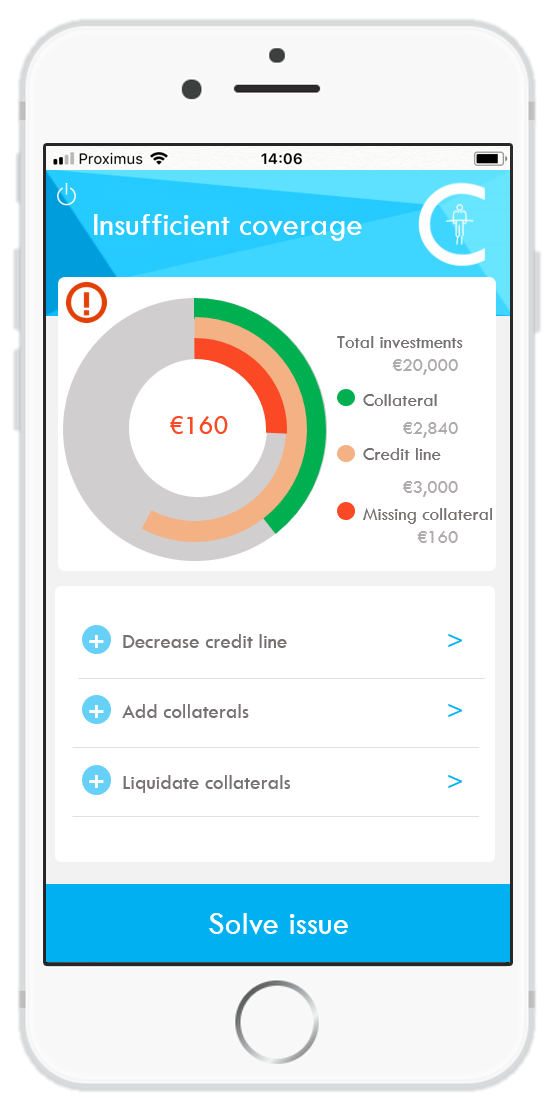

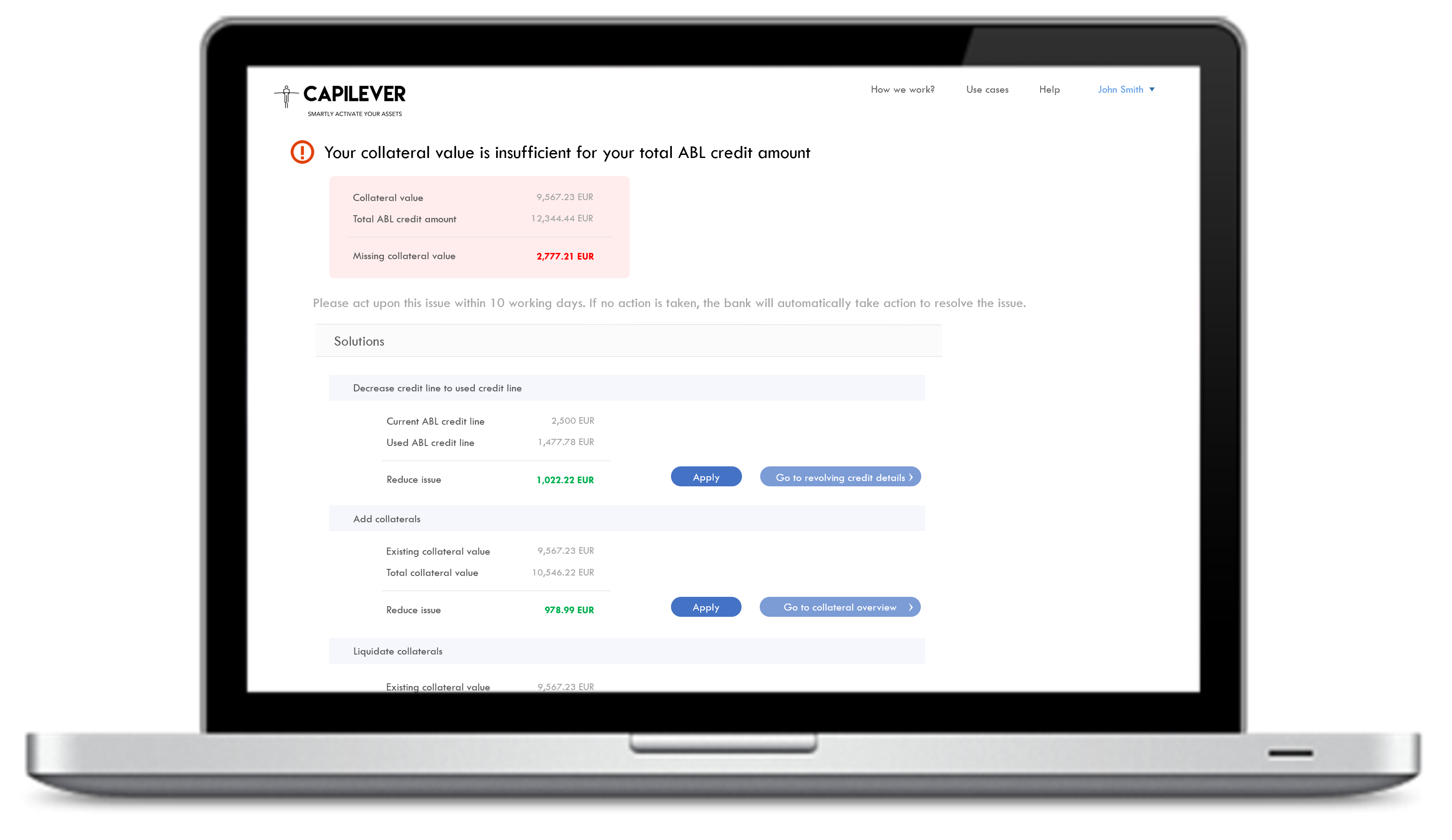

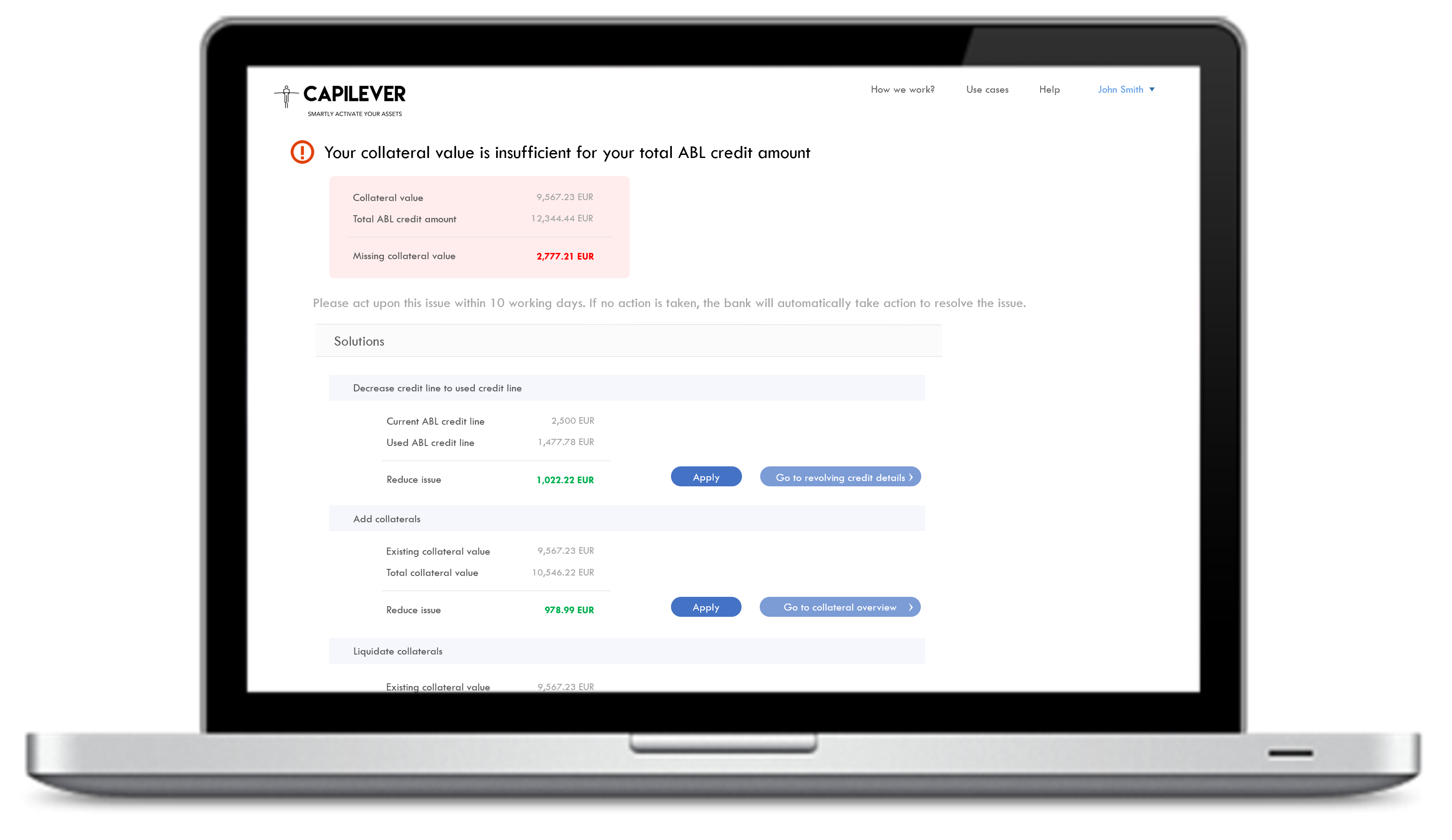

We periodically check when credits are no longer sufficiently covered and take action !

Our software generates alert to the SME or retail customer to correct as soon as possible (i.e. by blocking additional assets, repaying installment loans or reducing revolving credit amount). If issue stays open for more than x days we automatically block additional assets and/or decrease revolving credit (up to the current used credit amount) and/or start selling most risky blocked positions (resulting in cash, which has higher ratio of collateralization value to market value)

We periodically check when credits are no longer sufficiently covered and take action !

Our software generates alert to the SME or retail customer to correct as soon as possible (i.e. by blocking additional assets, repaying instalment loans or reducing revolving credit amount). If issue stays open for more than x days we automatically block additional assets and/or decrease revolving credit (up to the current used credit amount) and/or start selling most risky blocked positions (resulting in cash, which has higher ratio of collateralization value to market value).

LABL use cases

Bridge unforeseen short-term cash-shortages

Steve earns 2.500 EUR net a month. Steve is cautious with his money and the last years he has bought a number of term deposits for a total worth of 10.000 EUR. This month of October is however a hard month for Steve. All bills seem to come together this month. He already paid this month land registry tax and the university tuition fees for his daughter, resulting that his current account is now in debit for 1.100 EUR (while he has a maximum debit allowed for 1.200 EUR). Unfortunately he only gets his salary the 28th of the month and the 20th he still has to pay his annual house insurance fee for an amount of 900 EUR. Normally Steve would have to call his bank to increase his allowed debit amount or to liquidate one of his term deposits, but both actions are costly, difficult and most likely not ready before the 20th (given today is the 19th).

Luckily his bank is an innovative bank, which offers the “asset-based lending” product. Steve logs into the internet banking solution of his bank, selects 1 term deposit with a value of 2.000 EUR (giving a collateral value of 1.900 EUR) and asks to open a revolving credit line for this amount. Immediately the allowed debit amount of his current account increases from 1.200 EUR to 3.100 EUR. Steve doesn’t need to worry anymore about his insurance fee payment. Next day his insurance fee is paid and his account has a balance of -2.000 EUR now. On the 28th his company debits his salary, which increases his balance to 800 EUR. The credit line of 1.900 EUR can however stay open for later reuse as long as the collateral term deposits are not (don’t need to be) liquidated.

Finance a purchase, fast, flexibly and cost-efficiently

John wants to buy a new television of 3.000 EUR, but doesn’t have enough liquid money at the moment. He has a securities portfolio with a value of 25.000 EUR, but as stock exchange is a bit low at the moment, he doesn’t want to liquidate any positions for his television.

John doesn’t want to open a consumer credit at his bank, as this would be a difficult and long process (not able to complete in 5 minutes on his mobile in the shop) and would also be too costly (too high interest rate). Normally John would postpone his acquisition and save every month 250 EUR, allowing him to buy his new television next year, but thanks to the “asset-based lending” product, he doesn’t need to wait.

John takes his mobile, selects 4 positions from his securities portfolio (with a total value of 10.000 EUR, but with a collateral value of 3.800 EUR) to act as collateral and inputs that he wants to open an installment loan on a period of 14 months. After signing the transaction, his current account is immediately credited with 3.000 EUR. John walks to the register and buys his television using his bank card.

SME unforeseen short-term financing

Richard has his own company, specialized in renovating bathrooms. The company is doing well making a decent profit every year. Richard wants to expand his business in 3 years by opening a workshop where he can build tailor-made bathroom furniture himself. This investment includes not only a building, but also expensive equipment. Richard has therefore invested all his past profits in a term deposit paying out in 3 years.

Unfortunately Richard has had a serious accident with his van last week. As the van was already 8 years old, the insurance doesn’t pay out enough to pay a new van. Richard therefore needs 10.000 EUR to buy a new van.

Richard decides to open an “asset-based lending” based installment loan on 2 years for 10.000 EUR. He uses the term deposit with redemption in 3 years as collateral. This way Richard can easily and quickly finance his new van.

Investment hedging

Elaine is an active investor. Thanks to her good investment decisions, she has built up a nice portfolio of 100.000 EUR, mainly in large company stocks. Elaine expects the stock market to do extremely well in the coming months, thanks to the excellent economic climate. Unfortunately Elaine has no spare money to invest additionally and is convinced that all her positions in her portfolio will do also excellent in the coming months.

Normally Elaine would just keep her current portfolio, but her bank recently introduced the new “asset-based lending” product, which is perfect for investors like Elaine. Given that Elaine expects to gain 5% on her portfolio of 100.000 EUR in the coming 3 months, she says she can take a big risk with this expected profit of 5.000 EUR.

Elaine blocks 2 positions for a total value of 9.000 EUR, but with a collateral value of 5.500 EUR. For this collateral value, she opens an installment credit for 5.000 EUR with a duration of 3 months and with a “bullet” repayment (i.e. full repayment, i.e. capital and interest at end of the loan). The 5.000 EUR is immediately debited on her current account and she invests this money in a number of call options with duration of 3 months.

3 months later the stock market has indeed performed like Elaine expected. Her base portfolio has indeed increased from 100.000 EUR to 105.000 EUR and her options have provided a profit of 25%, i.e. the options are closed at 6.250 EUR. Elaine pays back the bullet loan. Thanks to the short duration and the interesting pricing of the asset-based lending (interest rate only 1,25%) Elaine only has to pay 10,50 EUR of interests, meaning she pays back 5.010,50 EUR.

The result is Elaine has now a portfolio of 106.239,50 EUR, giving a return of 6,2% instead of 5%.

Bridge unforeseen short-term cash-shortages

Steve earns 2.500 EUR net a month. Steve is cautious with his money and the last years he has bought a number of term deposits for a total worth of 10.000 EUR. This month of October is however a hard month for Steve. All bills seem to come together this month. He already paid this month land registry tax and the university tuition fees for his daughter, resulting that his current account is now in debit for 1.100 EUR (while he has a maximum debit allowed for 1.200 EUR). Unfortunately he only gets his salary the 28th of the month and the 20th he still has to pay his annual house insurance fee for an amount of 900 EUR. Normally Steve would have to call his bank to increase his allowed debit amount or to liquidate one of his term deposits, but both actions are costly, difficult and most likely not ready before the 20th (given today is the 19th).

Luckily his bank is an innovative bank, which offers the “asset-based lending” product. Steve logs into the internet banking solution of his bank, selects 1 term deposit with a value of 2.000 EUR (giving a collateral value of 1.900 EUR) and asks to open a revolving credit line for this amount. Immediately the allowed debit amount of his current account increases from 1.200 EUR to 3.100 EUR. Steve doesn’t need to worry anymore about his insurance fee payment. Next day his insurance fee is paid and his account has a balance of -2.000 EUR now. On the 28th his company debits his salary, which increases his balance to 800 EUR. The credit line of 1.900 EUR can however stay open for later reuse as long as the collateral term deposits are not (don’t need to be) liquidated.

Finance a purchase, fast, flexibly and cost-efficiently

John wants to buy a new television of 3.000 EUR, but doesn’t have enough liquid money at the moment. He has a securities portfolio with a value of 25.000 EUR, but as stock exchange is a bit low at the moment, he doesn’t want to liquidate any positions for his television.

John doesn’t want to open a consumer credit at his bank, as this would be a difficult and long process (not able to complete in 5 minutes on his mobile in the shop) and would also be too costly (too high interest rate). Normally John would postpone his acquisition and save every month 250 EUR, allowing him to buy his new television next year, but thanks to the “asset-based lending” product, he doesn’t need to wait.

John takes his mobile, selects 4 positions from his securities portfolio (with a total value of 10.000 EUR, but with a collateral value of 3.800 EUR) to act as collateral and inputs that he wants to open an installment loan on a period of 14 months. After signing the transaction, his current account is immediately credited with 3.000 EUR. John walks to the register and buys his television using his bank card.

SME unforeseen short-term financing

Richard has his own company, specialized in renovating bathrooms. The company is doing well making a decent profit every year. Richard wants to expand his business in 3 years by opening a workshop where he can build tailor-made bathroom furniture himself. This investment includes not only a building, but also expensive equipment. Richard has therefore invested all his past profits in a term deposit paying out in 3 years.

Unfortunately Richard has had a serious accident with his van last week. As the van was already 8 years old, the insurance doesn’t pay out enough to pay a new van. Richard therefore needs 10.000 EUR to buy a new van.

Richard decides to open an “asset-based lending” based installment loan on 2 years for 10.000 EUR. He uses the term deposit with redemption in 3 years as collateral. This way Richard can easily and quickly finance his new van.

Investment hedging

Elaine is an active investor. Thanks to her good investment decisions, she has built up a nice portfolio of 100.000 EUR, mainly in large company stocks. Elaine expects the stock market to do extremely well in the coming months, thanks to the excellent economic climate. Unfortunately Elaine has no spare money to invest additionally and is convinced that all her positions in her portfolio will do also excellent in the coming months.

Normally Elaine would just keep her current portfolio, but her bank recently introduced the new “asset-based lending” product, which is perfect for investors like Elaine. Given that Elaine expects to gain 5% on her portfolio of 100.000 EUR in the coming 3 months, she says she can take a big risk with this expected profit of 5.000 EUR.

Elaine blocks 2 positions for a total value of 9.000 EUR, but with a collateral value of 5.500 EUR. For this collateral value, she opens an installment credit for 5.000 EUR with a duration of 3 months and with a “bullet” repayment (i.e. full repayment, i.e. capital and interest at end of the loan). The 5.000 EUR is immediately debited on her current account and she invests this money in a number of call options with duration of 3 months.

3 months later the stock market has indeed performed like Elaine expected. Her base portfolio has indeed increased from 100.000 EUR to 105.000 EUR and her options have provided a profit of 25%, i.e. the options are closed at 6.250 EUR. Elaine pays back the bullet loan. Thanks to the short duration and the interesting pricing of the asset-based lending (interest rate only 1,25%) Elaine only has to pay 10,50 EUR of interests, meaning she pays back 5.010,50 EUR.

The result is Elaine has now a portfolio of 106.239,50 EUR, giving a return of 6,2% instead of 5%.

Ready to get Started ?

Happy to discuss your next Credit & Investment innovation project