Problematic debt – A big taboo in search for a Fintech solution

28 April 2023

Taking on debt is not necessarily a bad thing, especially when debt is used to generate wealth, but in the current cost of living crisis, debt can easily spiral out of control. With an ever-increasing number of people struggling to pay off their bills and debts, problematic debt is a major concern… Read more

2022 market review for tackling financial stress

8 January 2023

What do Wise, Curve, Qover, Monese and Capilever have in common? Besides being Fintechs active in the financial services sector you will probably say not that much, but when you look at their recent product announcements you can see a common focus, which is on removing financial stress… Read more

Examples how to better guide customers in home loan decisions

9 November 2022

The decision to buy or renovate a home, is for most people the most important financial decision in their life. Not only are the involved amounts 10 to 100 times higher than most other financial decisions, there are also many decision factors to consider. Nowadays most banking clients only make a conscious decision about the tip of the iceberg… Read more

A Roadmap for Hyper-Personalized Lending

22 June 2022

In previous blogs, we have raised the concern that loans in general and mortgages in particular have become too much of a commodity product, for which price is nearly the only differentiator. Many customers are however unaware that the loan with the best price or interest rate may not necessarily be the best option for their specific situation… Read more

Credit trends (2021 update)

6 September 2021

At Capilever we closely follow innovations and evolutions in the credit space. While many financial players are investing heavily in transforming the credits domain, the financing products themselves have not changed significantly in the last few decades. Here we discuss some new trends and propose some new credit types… Read more

5 Capilever software tools that radically rethink financial products from their core

17 May 2021

Over the past 5 years, banking has been transformed from a risk-averse, very conservative sector to one of the fastest moving and innovating sectors in the world. Unfortunately most of these evolutions focus on innovating the user interaction with the banking channels or with financial products or services, rather than improving the products or services themselves … Read more

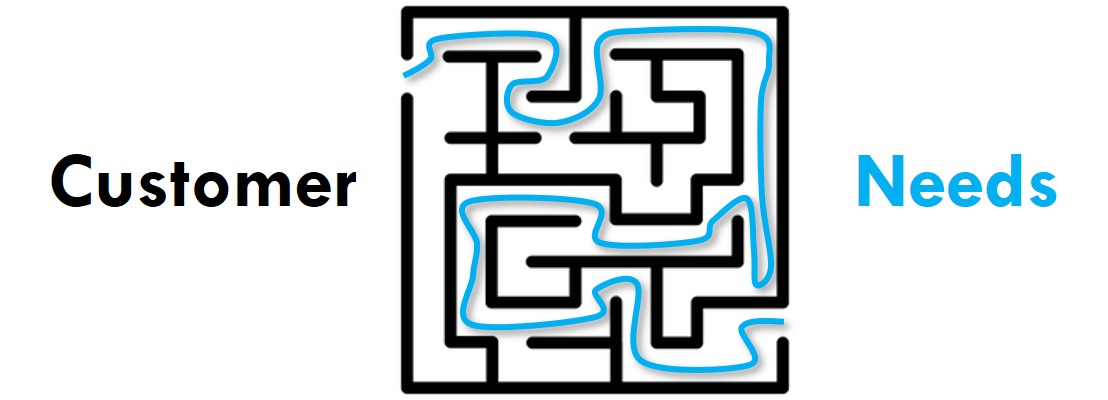

Identifying the customer needs before traditional credit origination

14 March 2021

In a world of hyper-personalization and customer-centricity, customers are expecting their banks to provide solutions to their needs, rather than having to find, buy and compose different financial products and services themselves. Capilever FINE guides customers towards the right products, including products they might never have thought about … Read more

Banks can help you build your path to financial freedom

15 January 2021

Despite significant efforts of schools and media to give more attention to financial skills, the level of financial literacy in the general population remains low. In this blog we explain some techniques implemented in the Capilever software that make it more simple for bank customers to understand their finances and financial health, ultimately enabling them to make more informed decisions and act more autonomously … Read more

How banks and insurers increasingly push risks towards their customers

22 November 2020

There is a trend within financial institutions to push risks towards their customers. This trend is driven by the market (high volatility on the stock market and the low interest rates), by regulators (imposing higher capital requirements) and by customers (wanting lower prices, higher returns and more personalized services) … Read more

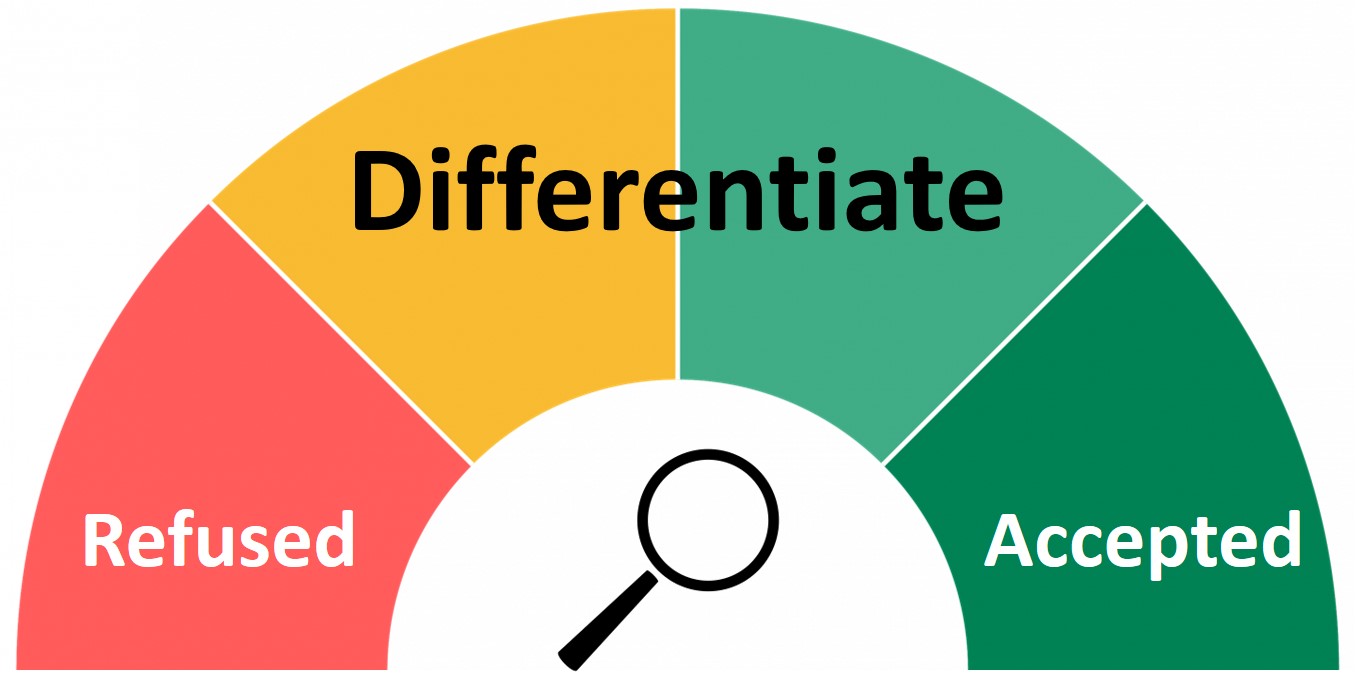

Improving traditional credit scoring with a forward-looking approach

28 October 2020

Credit history checks and national registers allow protecting customers against excessive debt. These checks however should be complemented by an “Affordability Check”, based on your current and expected financial situation. In this blog we explain how such an affordability check allows to be forward looking, instead of backward looking (i.e. traditionally looking only at your credit history) … Read more

More flexibility in business loans – No unnecessary luxury

10 October 2020

In February we published the blog “Are credits not too commoditized?” investigating how banks could differentiate more based on the services linked to credits, rather than just based on pricing / interest rate. The blog mainly focused on private purpose loans. In our next blog we present a few examples how banks can offer more value and flexibility for business loans … Read more

Investing – A spectrum of choices

14 September 2020

In our previous blog we introduced a number of ways how banks can activate the ever increasing amounts of saving deposits, by turning them into investments. However once customers have taken the decision to activate their money, they still have a variety of investment services and products to choose from… Read more

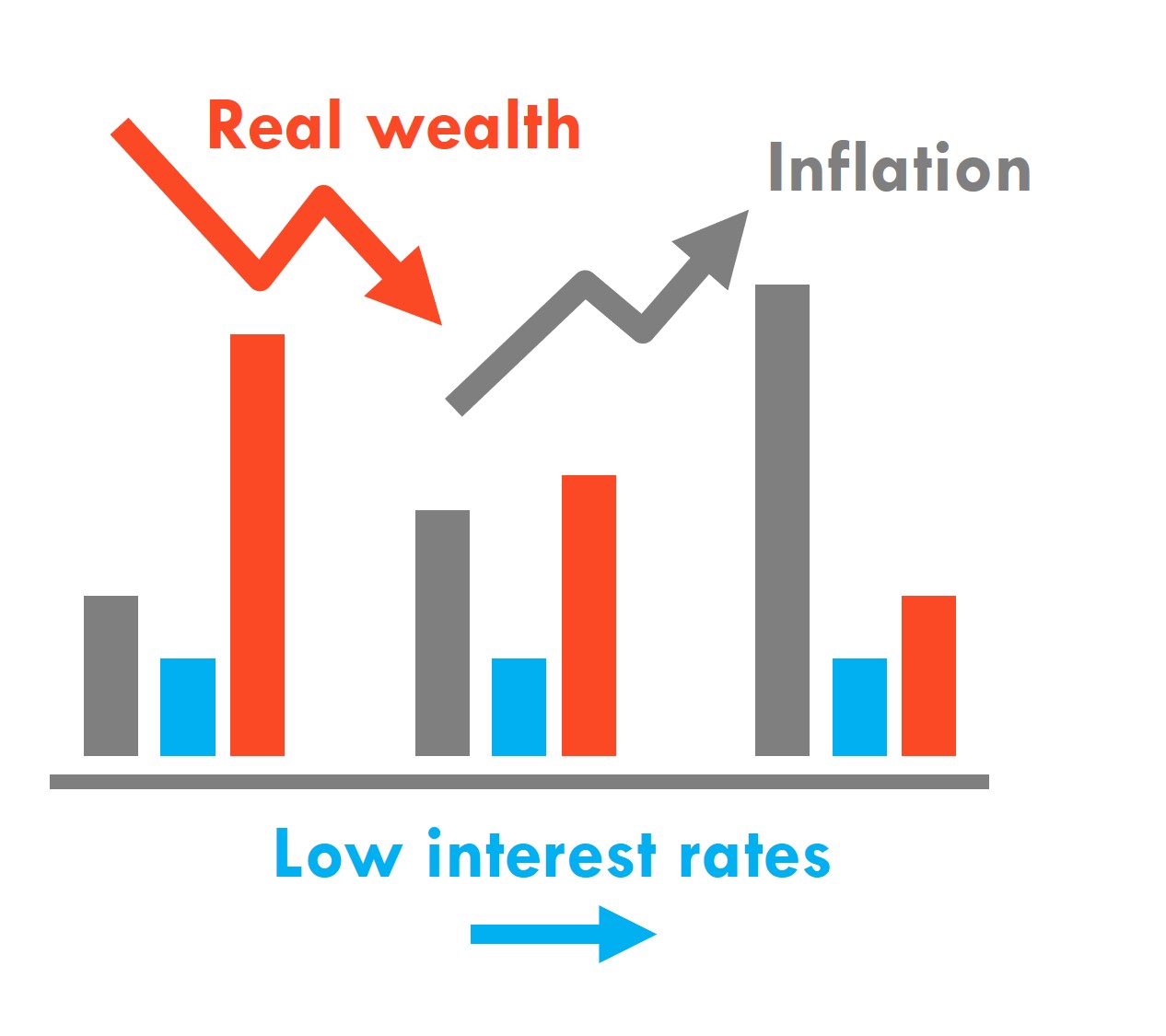

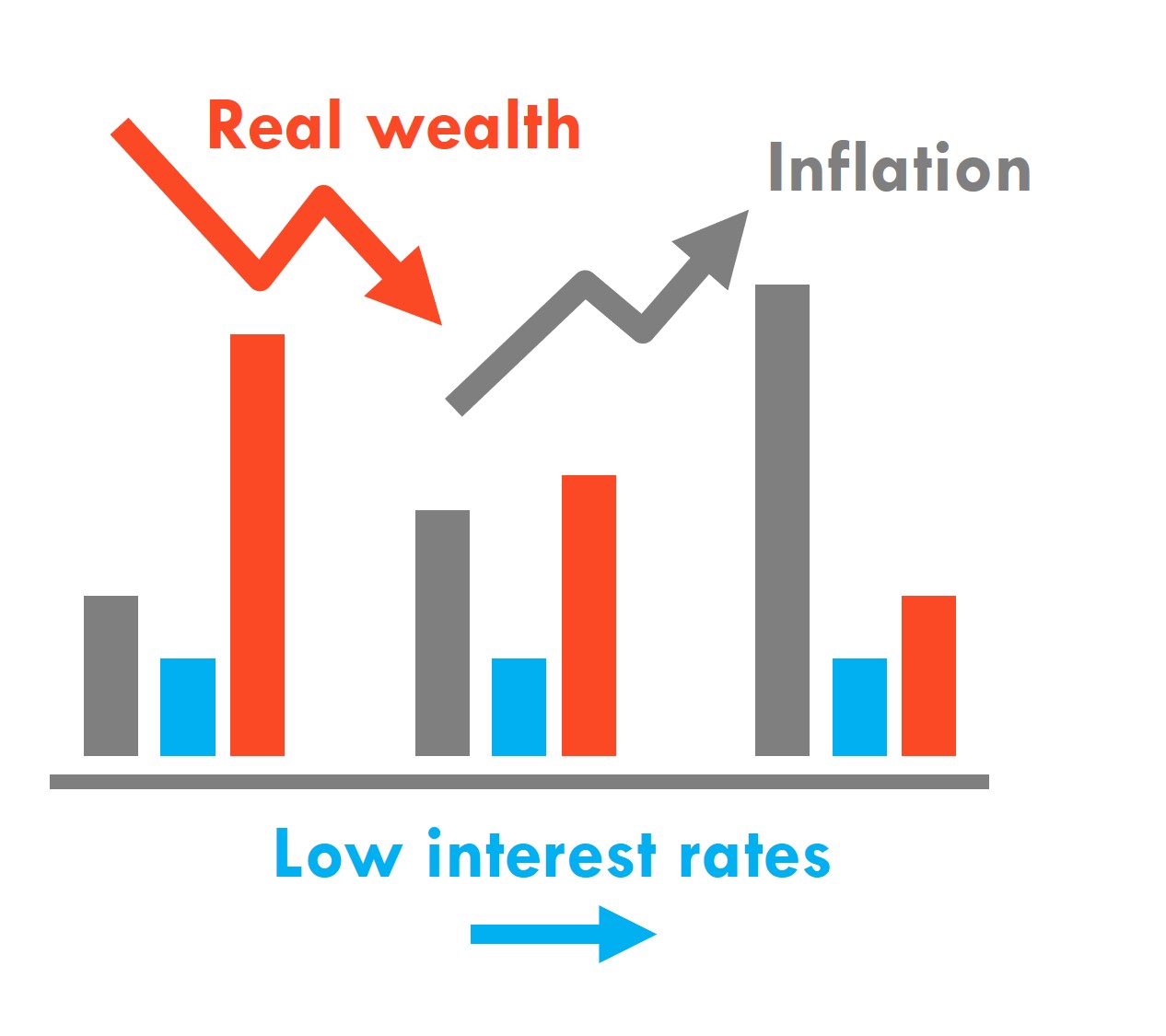

How Capilever can help activate savings to fight economic recessions

26 August 2020

With savings skyrocketing all over the world, an economic crisis is difficult to avoid, as consumption drops and investments are postponed. At Capilever, we believe a bank can activate these savings in 3 ways: by better educating its customers about impacts of inflation and interest rates, by making investing more accessible, and by providing flexible financial cushions… Read more

Credit scoring – Art or science?

30 July 2020

Credit risk scoring models have evolved a lot in recent years thanks to the rise of new technologies like AI and the availability of more data sources. Capilever LABL, NLPT and CPRA software provide novel techniques for handling credit risk, increasing risk awareness and enabling customers to improve their credit scoring themselves… Read more

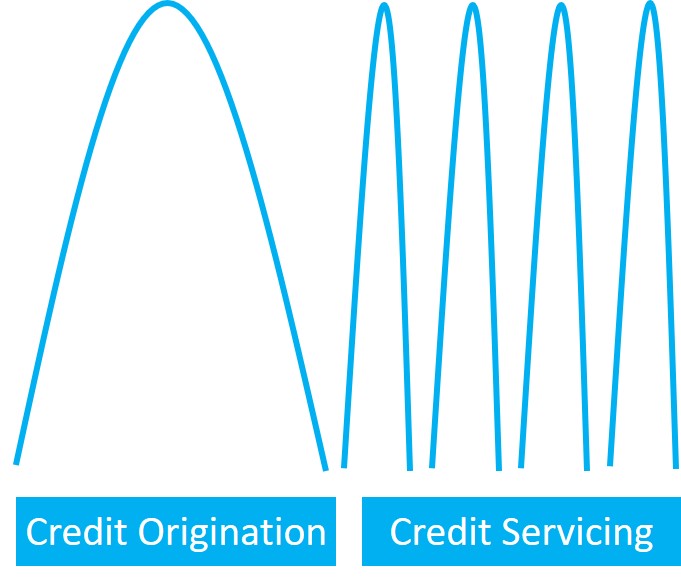

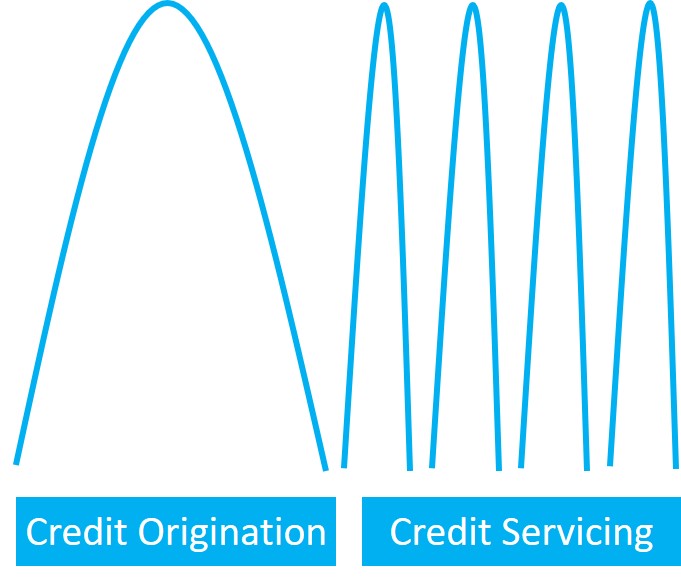

Credit servicing – Much more than just a back-end process

5 June 2020

While credit origination is considered as a very customer-centric process, the credit servicing part that comes afterwards is usually considered as a purely operational, back-end process. At Capilever we believe however that a more customer-centric approach in the credit servicing lifecycle can bring considerable added-value and competitive advantage… Read more

Credit origination – A lot of evolution on the horizon

5 June 2020

While consumer credits are becoming more automated and user-friendly to originate (for customers via online channels or for bank employees) all other credits are often still very manual and labor intensive to originate. This blog tries to give a description of the different steps in an origination process and how they can be innovated… Read more

Social distancing & Financial distancing – New counterparty risk models

27 May 2020

One could argue, that in a similar way that social distancing can limit the epidemic spread in the current health crisis, applying correct counterparty risk measures can prevent the contagion and propagation of financial defaults. Not by excluding companies from doing business, but by helping them with specific measures, hence avoiding a more systemic economic collapse … Read more

Living a debt-free life : Utopia or realistic aspiration?

29 April 2020

Recent surveys indicate that the biggest aspiration of millennials today is not to buy a house or to get married, but to become debt-free. Younger generations want to become more flexible in their life-choices, having more freedom to change jobs, houses, etc. They have seen their parents being restricted in certain life choices by the debt they carried along… Read more

Are banks ready for the Corona emergency measures imposed by governments?

22 March 2020

Amid the Corona crisis, governments worldwide are urgently deciding on numerous actions to limit the economic impact of this unprecedented health crisis. Top priority in these plans is to help people and businesses overcome a period of low to zero income, which completely breaks their predicted liquidity forecasts. Such a shock in liquidity can even bring strong businesses on their knees, if no supporting measures are put in place … Read more

Are credits not too commoditized?

25 Feb 2020

Since 1 July 2007, the Belgian electricity market has been liberalized. While in the first years, only few consumers switched electricity provider, this has reached a new high this year. The electricity market has become fully commoditized and price has become the only differentiator. It’s interesting now to make the analogy with the banking sector … Read more

The best way to regain your customer’s trust

29 Jan 2020

After the 2007-2008 banking crisis, the trust of consumers in the banking sector reached an all-time low. For a sector built on the foundation of trust, this is alarming. But also a great opportunity! Banks which can rapidly regain the trust of their customers, are likely to attract new customers and better retain their existing customers … Read more

Can banks help to fundamentally redefine our notion of trust?

21 Nov 2019

Trust is the glue that holds society together. Historically we trusted people in our local community. Later this evolved to a centralized trust in large corporations and institutions, but recently this has shifted towards a more distributed trust, meaning that we sometimes need to place our faith in complete strangers … Read more

Being unique is not enough – how to assess the impact of a new banking solution

24 Oct 2019

When positioning a new solution, banks first have to analyse the business case, i.e. compare the costs of implementing, operating, marketing and selling the new product or service versus the increased revenues and reduced costs (directly measurable) and increased customer experience and brand value (indirect and hence more difficult to measure). As banks have the critical mass of their large existing client base, the cost of marketing the new solution is typically lower than for a new start-up positioning the same product or service … Read more

Banks that can maximally reduce financial risks in a user-friendly way can compete with any future tech player

24 Sept 2019

Banks are technology companies with a banking license ! This claim and similar claims can be read more and more in articles on trends in the financial services sector and is often used as an argument that banks will soon be replaced by Fintechs and Silicon Valley tech giants. At Capilever we strongly believe that IT is crucial for a bank and its importance can hardly be underestimated, but – call us conservative – we also believe that risk management is equally important as a bank’s core business … Read more

How collaboration with specialist providers can boost bank innovation

3 Sept 2019

Bank offerings and customer expectations are evolving fast. For each specific client need, specific solutions need to be built, requiring lots of investments, IP and expertise. To keep up, banks can’t afford to reinvent the wheel every time. Therefore they are opening up, and welcoming the win-win collaboration with specialist third parties that can help them improve their offering … Read more

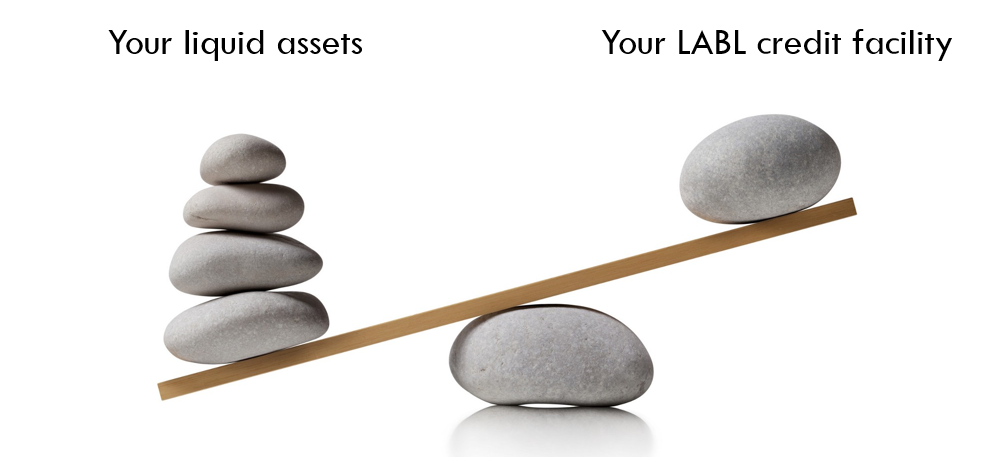

Why lending against your investments is perfectly compatible with daily banking and PFM/BFM offerings

18 July 2019

Today’s bank customers want a fluent, end-to-end experience. Unfortunately most Online and Mobile banking platforms are still very silo organised, with typically modules for Daily Banking, Investments, Credits and Insurances. Even though this reflects very well the internal (IT) organisation of the bank, customers would prefer to have a more customer-oriented cockpit, where they can manage end-to-end solutions and not banking products … Read more

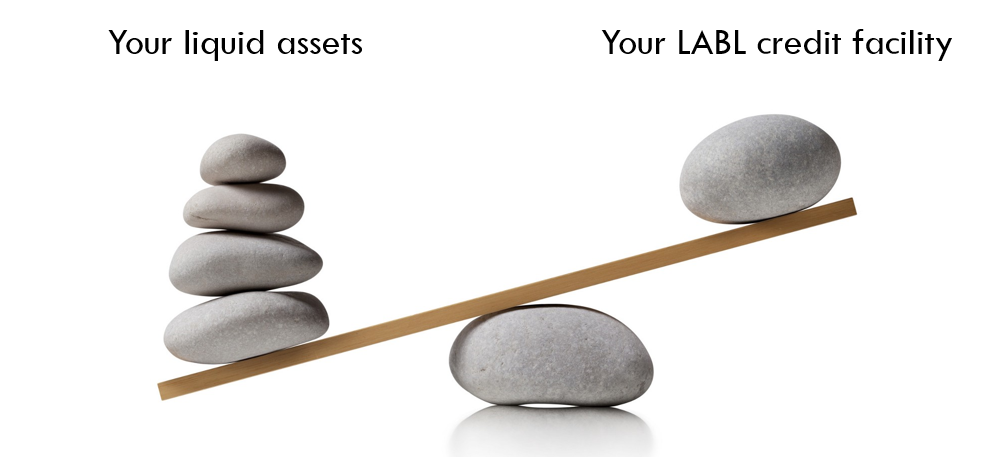

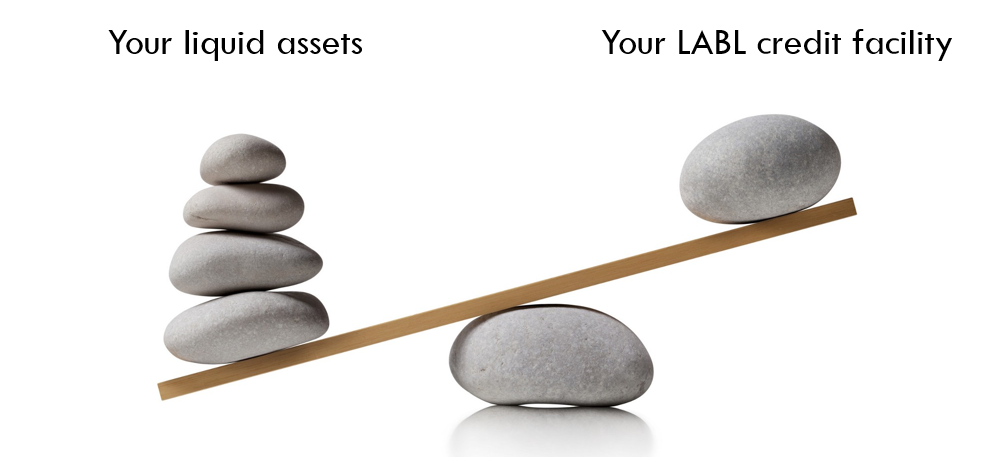

Liquid Asset Based Lending (LABL) – a clear retail banking market opportunity

18 December 2018

Lending against liquid marketable assets like securities and bonds, has been around for quite some time. Nowadays, we find LABL or Lombard loans mostly in the private banking segment. High net worth individuals can borrow against some of their assets. In the corporate space this type of lending facility is also frequently available, offering flexible credit lines and working capital for large corporates. Finally a great opportunity is available in the retail and SME banking space … Read more

Lending against liquid marketable assets like securities and bonds, has been around for quite some time. Nowadays, we find LABL or Lombard loans mostly in the private banking segment. High net worth individuals can borrow against some of their assets. In the corporate space this type of lending facility is also frequently available, offering flexible credit lines and working capital for large corporates. Finally a great opportunity is available in the retail and SME banking space … Read more

Welcome to our blog !

Welcome to the Capilever blog ! Our blog will give us the unique opportunity to share news and updates, while also offering a place for us to interact with our network.

Lending against liquid marketable assets like securities and bonds, has been around for quite some time. Nowadays, we find LABL or Lombard loans mostly in the private banking segment. High net worth individuals can borrow against some of their assets. In the corporate space this type of lending facility is also frequently available, offering flexible credit lines and working capital for large corporates. Finally a great opportunity is available in the retail and SME banking space …

Lending against liquid marketable assets like securities and bonds, has been around for quite some time. Nowadays, we find LABL or Lombard loans mostly in the private banking segment. High net worth individuals can borrow against some of their assets. In the corporate space this type of lending facility is also frequently available, offering flexible credit lines and working capital for large corporates. Finally a great opportunity is available in the retail and SME banking space …