How Capilever can help activate savings to fight economic recessions

26 August 2020

With savings skyrocketing all over the world, an economic crisis is difficult to avoid, as consumption drops and investments are postponed.

While at first sight these unused savings seem to be a jackpot for banks in terms of increasing net interest income (difference between credit interest payable by the bank and debit interests receivable and/or linked investment returns), this is rarely the case, as profits on savings have also dropped (due to the increasing buffers banks are required to hold for guaranteeing these savings and the fact that banks have difficulties to invest the money in safe and profitable assets) and holding large savings does not create a strong customer relationship (meaning the retention risk is high).

At Capilever, we believe a bank can activate these savings in 3 ways:

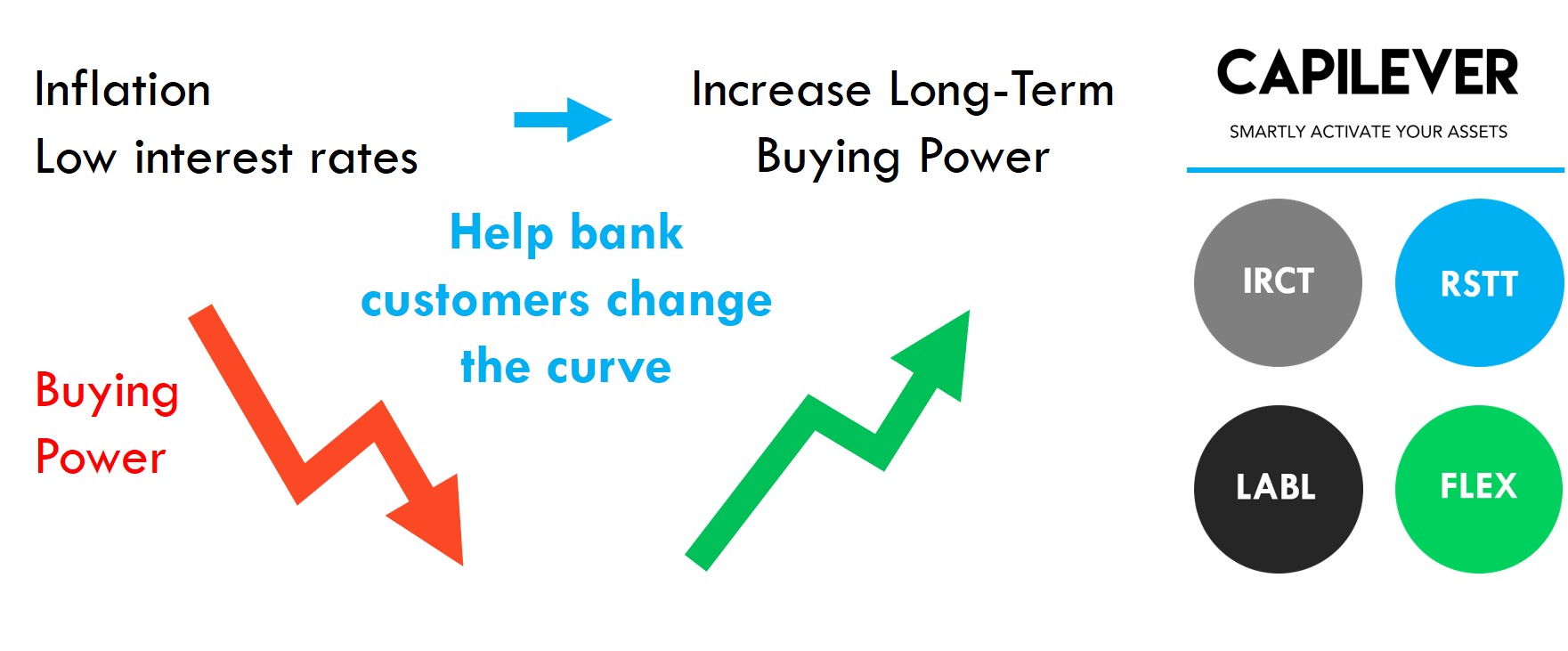

- By better educating its customers, that saving money today is actually losing money on the long-term, as interest rates on saving accounts are lower than the inflation rate, meaning a loss of buying power in the long term

- By making investing more accessible, i.e. more user-friendly, more accessible to the layman, cheaper and more automated

- By providing more flexible, cheaper and faster financial cushions in the form of credits, so that customers don’t need to provision such a cushion themselves in the form of highly liquid saving accounts

Let’s explore these 3 methods in a bit more detail.

First we have the method of educating the customer. The main issue there is that for many bank customers the concept of inflation is hard to grasp and not always tangible. Using the data collected by PFM tools, a bank can easily simulate how the monthly expenses of a customer will look like in 5 years, in 10 years, etc. This makes it more tangible for the customer to understand as it is based on their own personal situation. Afterwards the impact on a saving account can be explained. This can also be visualized by using real financial data of the customer, for example their weekly supermarket spending. A customer with 15,000 EUR in savings and a weekly 150 EUR supermarket bill, can fill their shopping cart 100 times. However, at an inflation rate of 1% and an average interest rate on a saving account of 0.2%, this means that in 10 years the customer can only fill ~92 shopping carts. By clearly visualizing this (e.g. by showing logos of shopping carts), the customer will get a better feeling of the impact of inflation and saving on their personal situation.

This type of easy simulation of interests combined with inflation, is exactly what the IRCT tool (Interest Rate Comparison Tool) of Capilever aims to deliver. In addition, Capilever IRCT also enables customers to compare different banking products, simulating the impact of inflation, and making better informed decisions.

Secondly there is the option to make investing more accessible. Over the last years, banks have already put a lot of efforts into this, with robo-advise, automatic investment plans, automatic investing of expense roundups or spare change, capital guaranteed funds, etc. Although all these initiatives are excellent steps towards promoting investments, all these tools are very directive and opinionated, i.e. the bank is taking over the investing from the customer and hiding away all investment choices.

We believe there is still a large opportunity for tools where the customer stays in full control of every investment decision and where the complexity of investing is not hidden away but strongly facilitated by user-friendly wizards and tooling.

Capilever’s RSTT tool (Retail Securities Trading Tool) exactly achieves this by providing a user-friendly trading platform for execution-only self-service trading, where the investor is guided and assisted in every investment decision, but still remains in full control. The tool aims to provide a number of accessible techniques to maximally mitigate the market risk taken by the investor in a very simple and transparent way.

Finally, there is the need for banks to assist their customers in creating a safety cushion. A good market practice is to recommend customers to keep between 3 and 6 months of typical monthly expenses (with a minimum of 10,000 EUR) in a highly liquid form (such as a saving account). For many people however this means that all their savings will be put on a saving account.

One could argue that it is unproductive that each banking customer has to provision such a safety cushion themselves, while the average period such a cushion remains unused might be months or even years. Instead banks should provide alternative solutions for this short-term liquidity cushion, so that customers can plan their financing towards the medium- to long-term. If banks can provide flexible and cheap ways to bridge temporary liquidity issues, this safety cushion can be invested in more long-term and more profitable (while still secure) assets.

In the Capilever offering, we have 2 products that exactly offer this flexibility, i.e.:

- LABL (Liquid Asset Based Lending), which provides a flexible and cheap way to lend money with your medium- to long-term investments as collateral. This type of product gives an excellent tool for customers to invest in the long-term, while still having a cheap, flexible and fully liquid safety cushion for the short-term (offered by the bank in the form of a Lombard credit).

- FLEX (Financial Life Event Xeduler), which provides a long-term financial product combining a long-term investment and a long-term credit product. Idea is to balance out the short- to medium-term budget fluctuations in a highly flexible way, while achieving an equilibrium on the long-term. Via this product, customers again have easy and cheap access to short-term funding, while they can focus more on their medium- to long-term financial plans.

Additionally in order for banks to keep this short-term funding cheap, banks can request additional collaterals from the customer (like in the case of the above LABL product), but can also work with rule-based money, i.e. the received money is deposited by the bank on a specific account, which is not accessible by the customer, but instead automatically reimburses expenses occurring on the customer’s current account of a specific type (specific sector, location, specific merchant, etc.). This way banks can impose that the money is spent for a specific purpose, which also reduces the credit risk (thus allowing to reduce pricing).

The above ideas demonstrate that banks can be very innovative when it comes to activating savings and that this activation can provide strong opportunities for banks to increase their revenues (from interest income to commission income) and improve the long-term customer relationship. Capilever has a number of tools in its offering helping this innovation, but this is just the tip of the iceberg. We would be happy to discuss this in more detail with your teams.