Interest Rate Comparison Tool (IRCT)

Chose lending and investment products that best suit your strategy, risk appetite and vision on interest rate evolutions

Banks provide a variety of loans and interest-rate linked investment products, with a variety of interest rate conditions and maturity periods. For a bank customer, it is almost impossible to make a well-informed and fast decision for the right product, as simulation tools are not really available. The IRCT tool aims to provide a clear overview of how different loan & investment products with fixed and variable interest rate and different durations react on evolutions in the interest rate.

Interest Rate Comparison Tool (IRCT)

Chose lending and investment products that best suit your strategy, risk appetite and vision on interest rate evolutions

Banks provide a variety of loans and interest-rate linked investment products, with a variety of interest rate conditions and maturity periods. For a bank customer, it is almost impossible to make a well-informed and fast decision for the right product, as simulation tools are not really available. The IRCT tool aims to provide a clear overview of how different loan & investment products with fixed and variable interest rate and different durations react on evolutions in the interest rate.

How does it work?

1

Select products

Customer selects the different loan/investment products he wants to compare. When products have different maturity periods, IRCT proposes whether customer wants to compare with automatic roll-over. For investment products with distribution of interests, IRCT asks if distributed interest need to be reinvested.

2

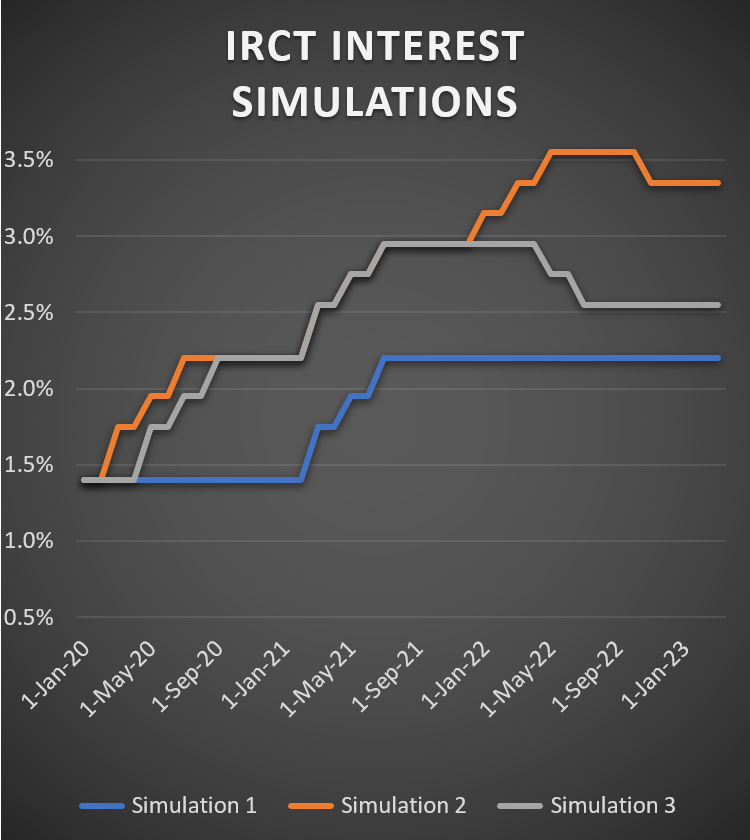

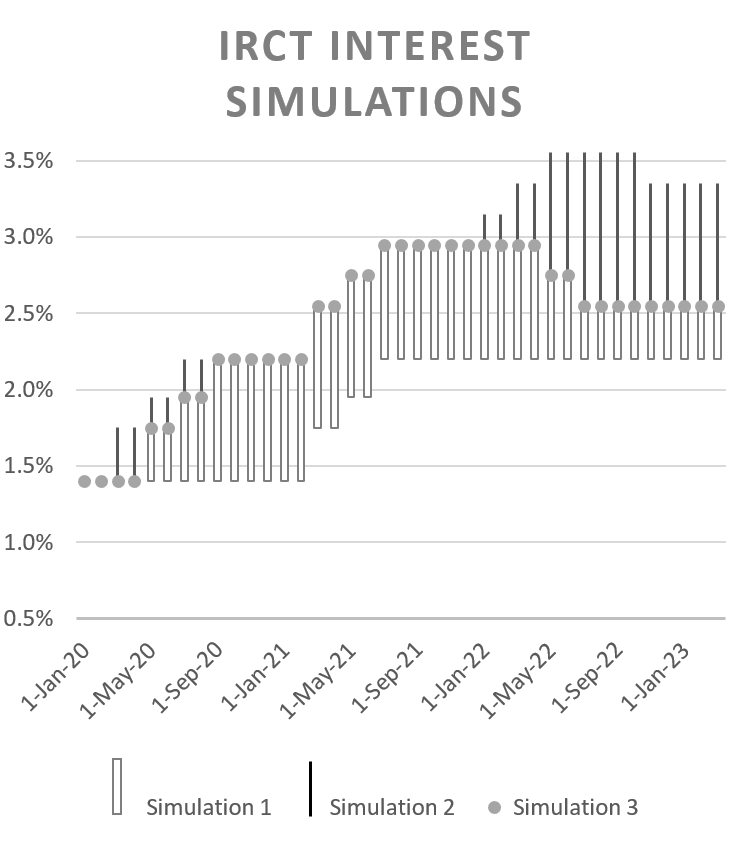

Perform simulations

Customer can simulate evolution of the interest rate (both debit and credit) between now and maturity date of longest selected product. The customer can move the graph by dragging & dropping some of the interest rate points. IRCT does some initial suggestions like flat, increasing or decreasing interest rate.

3

Take well-informed decisions

In a visual and comprehensive way, IRCT compares the selected products. The tool shows the balances between investment gains and lending costs for the different interest rate scenarios. The customer can take a well-informed decision for an investment (long) respecting their strategy, risk appetite and vision on interest rate evolutions.

1

Select products

Customer selects the different loan/investment products he wants to compare. When products have different maturity periods, IRCT proposes whether customer wants to compare with automatic roll-over. For investment products with distribution of interests, IRCT asks if distributed interest need to be reinvested.

2

Perform simulations

Customer can simulate evolution of the interest rate (both debit and credit) between now and maturity date of longest selected product. The customer can move the graph by dragging & dropping some of the interest rate points. IRCT does some initial suggestions like flat, increasing or decreasing interest rate.

3

Take well-informed decisions

In a visual and comprehensive way, IRCT compares the selected products. The tool shows the balances between investment gains and lending costs for the different interest rate scenarios. The customer can take a well-informed decision for an investment (long) respecting their strategy, risk appetite and vision on interest rate evolutions.

BENEFITS OF IRCT

-

Reassured customers

The customer can take a more conscious decision for an investment / long, with regards to interest rate risk. He can chose the products that best suit their strategy and risk appetite

-

Better informed

The bank can better inform customers about the impact of choosing a product, either through self-service channels or bank employees (credit managers, investment managers, etc.). Ultimately enhancing the financial literacy of their customers.

-

Better advice

Assist bank employees in providing better advice to customers. For example when comparing a mortgage of 20 years with fixed interest rate, compared to a 3/6/9 variable interest rate formula, with a cap of maximum 2%, etc.

-

Enable new offerings

Banks can provide more innovative interest-linked loan/investment products (see Capilever FLEX product), as ICRT tool can easily and graphically explain how capital gains and costs will evolve with fluctuating interest rates

-

Reassured customers

The customer can take a more conscious decision for an investment / long, with regards to interest rate risk. He can chose the products that best suit their strategy and risk appetite

-

Better informed

The bank can better inform customers about the impact of choosing a product, either through self-service channels or bank employees (credit managers, investment managers, etc.). Ultimately enhancing the financial literacy of their customers.

-

Better advice

Assist bank employees in providing better advice to customers. For example when comparing a mortgage of 20 years with fixed interest rate, compared to a 3/6/9 variable interest rate formula, with a cap of maximum 2%, etc.

-

Enable new offerings

Banks can provide more innovative interest-linked loan/investment products (see Capilever FLEX product), as ICRT tool can easily and graphically explain how capital gains and costs will evolve with fluctuating interest rates

INTEGRATE OUR APIs INTO YOUR DAILY BANKING APP

IRCT use case

Emily and Peter need a mortgage loan. Thanks to the IRCT tool, they can choose the formula that best matches their budget, future expectations and risk profile

Emily and Peter want to buy a house and need to take a mortgage loan. After careful comparison between different banks, they found that their own bank gives the best interest rates and service. After a visit to their branch, the bank employee has made a number of offers for Emily and Peter :

- A fixed rate offer for 30 years at 2,1%

- A fixed rate offer for 20 years at 1,7%

- A variable rate (formula 1/1/1) offer for 20 years at 1,5% (with cap of +2%)

- A variable rate (formula 3/6/9) offer for 20 years at 1,6% (with cap of +2%)

Emily and Peter now need to decide which formula best fits their budget and future expectations and risk profile. Luckily their bank offers the IRCT tool of Capilever. When they logon to their online banking the 4 products offered by the bank are automatically available. Emily and Peter select the 4 products for comparison and enter a first situation of a bank interest rate (e.g. Euribor) staying flat at 1,2% for 30 years. The tool automatically shows how the 4 formulas react to this situation and what are the resulting reimbursement tables.

Afterwards, Emily and Peter look at a few other scenarios, for example scenario where interest rate doubles after 1 year and triples after 3 years. And also a scenario, where interest rate gradually increases a little bit and then drops again after 10 years.

Based on all these comparisons Emily and Peter decide to go for the variable rate (formula 1/1/1) as it best suits their expectations of the interest rate evolution.

Emily and Peter need a mortgage loan. Thanks to the IRCT tool, they can choose the formula that best matches their budget, future expectations and risk profile

Emily and Peter want to buy a house and need to take a mortgage loan. After careful comparison between different banks, they found that their own bank gives the best interest rates and service. After a visit to their branch, the bank employee has made a number of offers for Emily and Peter :

- A fixed rate offer for 30 years at 2,1%

- A fixed rate offer for 20 years at 1,7%

- A variable rate (formula 1/1/1) offer for 20 years at 1,5% (with cap of +2%)

- A variable rate (formula 3/6/9) offer for 20 years at 1,6% (with cap of +2%)

Emily and Peter now need to decide which formula best fits their budget and future expectations and risk profile. Luckily their bank offers the IRCT tool of Capilever. When they logon to their online banking the 4 products offered by the bank are automatically available. Emily and Peter select the 4 products for comparison and enter a first situation of a bank interest rate (e.g. Euribor) staying flat at 1,2% for 30 years. The tool automatically shows how the 4 formulas react to this situation and what are the resulting reimbursement tables.

Afterwards, Emily and Peter look at a few other scenarios, for example scenario where interest rate doubles after 1 year and triples after 3 years. And also a scenario, where interest rate gradually increases a little bit and then drops again after 10 years.

Based on all these comparisons Emily and Peter decide to go for the variable rate (formula 1/1/1) as it best suits their expectations of the interest rate evolution.

Ready to get Started ?

Happy to discuss your next Credit & Investment innovation project